Q1 Investors' Newsletter

January 2024

Galilee Investment Management

Message from COO

Mr. Lawrence, COO

Dear Valued Investors,

As we wrap up an exceptional year at Galilee, we are pleased to share the key highlights that define our success in 2023.

Our assets under management have experienced consistent growth. We have also upheld the highest standards of compliance, with no reporting issues, thanks to our rigorous KYC/AML screening and due diligence processes. Our investor base has expanded significantly, reflecting the trust place in us by an increasing number of discerning investors.

In 2023, Galilee hosted notable events, including the welcoming of Mr. Kim Rithy, Governor of Preah Vihear, Cambodia, and the celebration of a successful equity buyout with investors of the Cambodia Development Fund. Our presence in Cambodia was further solidified with the grand openings of Capri@228 and the Bytedc Data Center.

As we traverse the transition from the final chapters of 2023 to the dawn of 2024, we are thrilled to share a heartfelt update on Galilee Investment Management’s unwavering commitment to our vision: To be a Principled Conduit to Create Wealth with a Higher Purpose. Our journey is fueled by this principle, resonating deeply within our team and extending far beyond.

Social Outreach Highlights: A Journey of Impact and Commitment

GalileeHouse International Incorporation:

The roots of our social impact initiatives deepen with the incorporation of GalileeHouse International Pte. Ltd. on August 29, 2023, in Singapore. This marks the genesis of our ambitious Christian private school project in Phnom Penh, Cambodia. Despite temporary setbacks in obtaining regulatory licenses due to a nationwide review by the new Cambodian administration, our dedication to the cause persists.

In a demonstration of our unwavering commitment, we launched a 6-month English program for children from an abused women’s shelter here in Singapore. Weekly classes are now underway for a group of 10 children, ages 3 to 7, laying the groundwork for a brighter future.

5 Loaves & 2 Fish (5L&2F) Initiatives:

Our commitment to community outreach stands strong with the 5 Loaves & 2 Fish (5L&2F) Initiatives, embodying our dedication to serve the underprivileged in our communites.

1. Bless Groceries: Monthly $100 online grocery vouchers are offered to families in need, primarily supporting alumni families from the abused women’s shelter home.

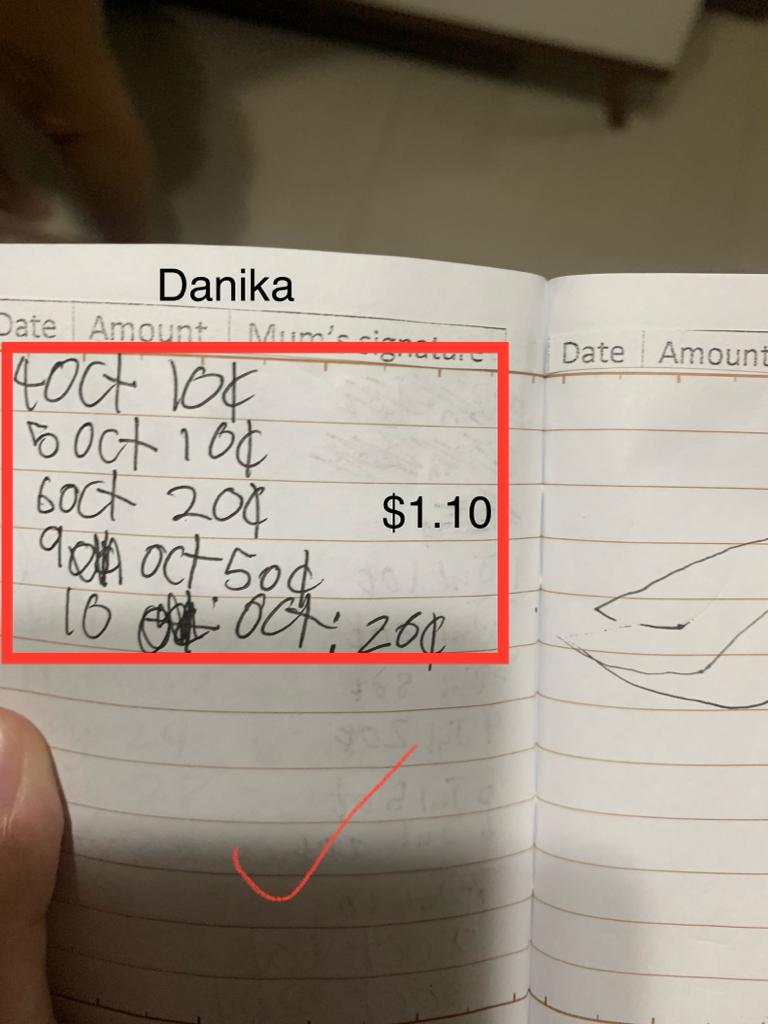

2. Living Well: Empowering children from shelter homes to save for their future, this initiative includes a dollar-for-dollar matching program, encouraging children to save a portion of their daily allowances, up to $5 per month. These savings are held in escrow until they transition out of the shelter home.

Currently benefiting five families, the monthly Bless Grocery vouchers, and the Living Well program have become integral parts of their lives. In 2024, we aim to extend this support to two additional families through the 5L&2F initiative. Furthermore, the Living Well program will find a new home with Morning Star, a Catholic community group supporting underprivileged children.

Across in Cambodia, we supported, through our cash gifts, our local partners in blessing the children from underprivileged homes.

Discipleship Training:

Our spiritual journey reached new heights in 2023 with the successful completion of the second year of our Discipleship@Galilee sessions. These monthly gatherings have become a cornerstone, engaging our staff, investors, and supporters. Participants are equipped with foundational tools to infuse faith into their daily lives. Expanding our reach, we extended these sessions to alumni of the Shelter Home, aiming to guide and support them on their spiritual journeys.

As we embark on the new year, our commitment to these initiatives stands resolute. They are a testament to our dedication to creating a positive impact, aligning with our vision while transcending religious boundaries.

We extend our heartfelt gratitude for your unwavering support in these endeavors. Together, we continue to chart a purposeful path, striving to make a meaningful difference in the lives we touch.

Partnership with Metis Global (sg): elevating Trust Planning for Our Investors

We are pleased to announce a strategic partnership with Metis Global (SG), a move that adds a new dimension to our commitment to wealth creation with a higher purpose.

About Metis (SG) :

A subsidiary of Metis Global Group Limited, Metis (SG) was established in 2013 by Dr. German Cheung to address the Trust gap for non-HNW investors. Expanding to Hong Kong in 2016 and the Cook Islands in 2019, Metis (SG) commenced operations in Singapore in 2021, regulated by MAS. Their mission is to democratize access to Trust plans, making them affordable and accessible, even for retail investors.

Trust Understanding and Strategic Benefits :

Metis (SG) specializes in offering Trust plans that provide wealth protection, ensure confidentiality, and streamline asset transfer. There plans offer advantages in succession and tax planning, asset protection, and family wealth management. Importantly, investors retain strategic control over their investment decisions.

Strategic Benefits for Galilee :

This partnership enhances Galilee’s offering of a new value-added service to our esteemed investors. By aligning with Metis (SG), we realize our aim of providing wholesome investment solutions that now covers the area of trust planning.

Next Steps :

1. Onboarding as Metis (SG)’s Parter (Completed) : We are excited to announce the successful onboarding process, formalizing our partnership with Metis (SG).

2. Training on Metis’ Trust Products (Scheduled in Jan 2024) : Our team is gearing up for in-depth training on Metis (SG)’s trust products in January 2024. This training will empower us to seamlessly integrate these value-added services to our investment solutions, ensuring you, our investors, receive the highest level of expertise and guidance.

Galilee New Office

We are pleased to announce that Galilee Office will be relocating to Trivex starting 2 January 2024.

Our new address will be 8 Burn Road #12-10 Singapore 369977 (Trivex).

That is all from me but do read on for fund specific updates. We would like to thank you for your patience and continued support. Please feel free to reach out to us if you have any feedback.

Regards

Lawrence Lim

fund Specific updates

Fund Description: The Fund was created to achieve a target annual compounded return of 18% net of fees through investment in residential real estate development in Cambodia. This closed-ended fund started in January 2020 and is targeted to close no later than December 2024. The target fund size is US$37 Million.

Fund Updates

We are proud to announce that Galilee had successfully completed the equity buyout of selected investors of the Cambodia Development Fund (CDF) on 21 July 2023 at a compounded net 15% return.

Check out some photos here from the event from our previous newsletter in case you missed them!

Latest Economic Developments in Cambodia

Check out the latest articles featuring Cambodia’s development and growth to understand why investing in Cambodia will continue to have a place in your investment portfolio.

The Ministry of Land Management Urban Planning and Construction (MLMUPC) granted licenses to 2,600 construction projects with a total investment of $4.96 billion within the first nine months of 2023. Full article here (Khmer Times).

Following the 19th Cambodian Government-Private Sector Forum (G-PSF) held in Phnom Penh this week, several new tax incentives were announced relating to property and development. Full article here (Khmer Times).

The “will it” or “won’t it” recovery seems to be an ongoing lingering question on the future of Sihanoukville. Without a doubt, the southern coastal region of Cambodia saw unprecedented booms. Full article here (Khmer Times).

Cambodia’s economy is projected to witness an upward swing in 2024 with an anticipated growth rate of 6.6%, pushing its gross domestic product (GDP) to approximately 142.96 trillion riel (roughly US$34.52 billion), as per the Ministry of Economy and Finance. Full article here (Phnom Penh Post).

Fund Description: Compounder Fund is an open-ended fund that focuses on long-term investing in public equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Updates

As of 30 November 2023, the fund is up 32.4% year-to-date compared to the S&P 500 index which is up 20.6%. Since inception on 13 July 2020, the fund is down 17.0% compared to the S&P 500 index which is up 47.1%.

Stocks continued their upward momentum in the fourth quarter of the year as both the S&P 500 and MSCI indexes recorded healthy gains.

Expectations of rate cuts in 2024 have helped to push valuations higher. Despite the strong gains in 2023 so far, Compounder Fund’s portfolio companies still possess relatively appealing valuations which we believe sets us up well for the long-term.

From a portfolio management perspective, we sold out our positions in Illumina and Upstart given the challenges that these companies are facing and the unpredictability around its future cash flows. We used the proceeds to increase our positions in The Trade Desk and Paycom.

From a fundamental standpoint, the companies in Compounder Fund’s portfolio performed well in the third quarter of 2023. Most companies in the portfolio exceeded management’s own expectations and while the macro environment remains uncertain, companies are starting to see stability in cash flows and deceleration of growth has slowed.

For 2024, while we expect the macroeconomic environment to remain uncertain, indicators point to the fact that our portfolio companies are resilient and will remain in a strong position to weather the storm.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Galilee Investment Fund VCC - Sub-Fund 1

Galilee Fixed Income Fund

Fund Description: Galilee Fixed Income Fund is an open-ended fund that focuses on sourcing out good quality assets which require debt funding, giving investors the opportunity to participate in specific projects of their choice. The Sub-Fund will invest primarily in real estate backed private or public fixed income products or deals. The Sub-Fund aims to provide investors with a stable annual dividend income yield of between 6-10% net of fees, paid out quarterly, over the long term.

Fund Updates

The first project launched for this Fund is structured as a Hospitality Fit-Out Debt Financing with an expected dividend payout of 7.5% per annum, paid quarterly with a 2-year term. This project allows investors to participate in providing debt financing for the fit-out of a series of hospitality developments to be managed by international brands such as Hilton, Citadines, Park Royal and Fraser Hospitality.

You can find a copy of our Project Factsheet here.

Click here or contact investor_relations@galileeinvestment.com if you wish to find out more!

Contact us

Kindly email us at investor_relations@galileeinvestment.com or contact your usual Galilee contact if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.)

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions.