Q1 Investors' Newsletter

January 2023

Message From CEO

Mr. Joseph Ong, CEO

Dear Investors,

As we welcome in the new year, I wanted to take a moment to express my sincere gratitude to our loyal investors, many of whom have remained with Galilee since inception and for the trust that they have placed in us. Also not forgetting my sincere appreciation to all our partners and members of the advisory committee!

In the past one year, we have successfully launched 2 new funds, expanded our team, conducted our inaugural investor educational webinar, implemented our new internship programme, whilst maintaining strict compliance with The Monetary Authority of Singapore’s regulations and requirements and constantly improving on our existing investment operations. Our team is excited and well-positioned to continue delivering more value for our investors in the coming year in line with our strategic objectives.

It has been a challenging year for everyone as we adapt to the changing economic environment but, your steadfast confidence in Galilee has been a constant source of motivation and inspiration for the Galilee team. Regardless of the uncertainties ahead, our team remains dedicated to grow our client’s investment by sticking to our investment mandates, while upholding our professional and diligent conduct and standards.

A quick update on our Cambodia Development Fund (“CDF”). We are pleased to announce that Galilee has received an offer to purchase CDF Preferential Shares held by Galilee-led investors and is currently in the process of evaluating the offer. We have scheduled for a few investor Q&A sessions this month to answer any questions that you may have on this buyout offer. Do sign up if you have not already done so via this link.

While economic challenges such as inflation, monetary tightening, and rising interest rates have impacted valuations across all asset classes, our Compounder Fund (“CPF”) has maintained its mandate to focus on selecting companies with great fundamental and growth potential. Again, we would like to thank our like-minded investors for helping CPF produce the behavioral edge and engage in long-term thinking about stocks by trusting in our mandate.

We are also happy to share that our two newly launched funds, our Real Estate Debt Fund (“REDF”) and Cambodia Real Estate Fund (“CREF”) are going according to plan. For REDF, more than S$7 million has been raised to date and the first two rounds of dividends were also declared and distributed successfully to our investors. For CREF, the due diligence process for a portfolio of Cambodian real estate assets has been completed, and the assets are currently undergoing external audit before being acquired by the fund. Further details about these assets will be shared at a later date.

Finally, in keeping with our tradition, we are delighted to introduce a pioneer member of our Advisory Committee, Mr. Leow Kim Keat. Mr. Leow has played a significant role in our company since the launch of our first fund in 2019, and his expertise and guidance had been invaluable in ensuring that we constantly improve our operations. We are thankful for his dedicated service and look forward to his ongoing contributions.

Mr. Leow Kim Keat,

Advisory Committee Member

Mr. Leow Kim Keat is a highly accomplished professional with a wealth of leadership experience in the semiconductor industry. He earned a degree in Chemistry and Math from the National University of Singapore and went on to build a successful career spanning over 32 years in test operations, wafer fab operations, supply chain, and procurement management for companies such as Texas Instrument, Chartered Semiconductor, and GlobalFoundries.

Throughout his career, Mr. Leow excelled in customer and supplier facing roles, using his expertise to help his companies reduce costs, streamline operations, and earn a reputation for working for win-win outcomes & for his integrity & his disciplined approach to work.

Mr. Leow has now retired and enjoys spending his free time playing golf, working out, and reading non-fictional books.

That is all from me but do read on for fund specific updates. We would like to thank you for your patience and continued support. Please feel free to reach out to us if you have any feedback.

Regards

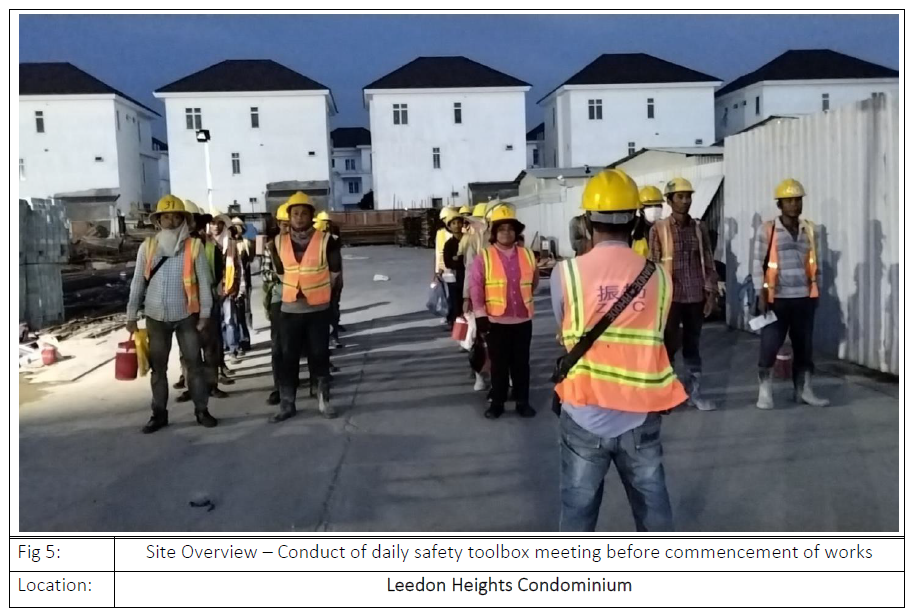

Investor Trips to Phnom Penh, Cambodia

Galilee had hosted its 4th investor trip into Phnom Penh, Cambodia since May 2022. The trip typically involves visits to our investment sites and experiencing Cambodia’s local culture through their food and places of interest. Check out some of our photos from recent trips below!

If you are interested to join us for our next investor trip to Cambodia, you can sign up via our Google Form or contact enquiry@galileeinvestment.com if you have any questions. You can check out a sample trip itinerary here.

Galilee internship Programme 2023

We are pleased to announce that Galilee has launched our internship programme 2023. In line with our goal to bring more value to our investors, we are prioritising internship placements for applicants who are from within our investor network.

If you have any questions, please contact hr@galileeinvestment.com.

Our Newly Launched Funds

Real Estate Debt Fund is an open-ended fund that focuses on sourcing out good quality assets which require private debt funding, giving investors the opportunity to participate in specific projects of their choice. The Sub-Fund will invest primarily in real estate backed private or public fixed income products or deals. The Sub-Fund aims to provide investors with a stable annual dividend income yield of between 6-10% net of fees, paid out quarterly, over the long term.

My Square Metre Fund VCC is an open-ended investment umbrella fund which will allow investors to participate in My Square Metre’s (Galilee’s strategic partner) growing real estate portfolio in Cambodia and the region through its sub-funds. This fund is only open by invitation to strategic investors.

fund Specific updates

Fund Description: The Fund was created to achieve a target annual compounded return of 18% net of fees through investment in residential real estate development in Cambodia. This closed-ended fund started in January 2020 and is targeted to close no later than December 2024. The target fund size is US$37 Million.

Fund Updates

- Galilee has received an offer to purchase CDF Preferential Shares held by Galilee-led investors and is currently in the process of evaluating the offer.

- We have also scheduled for a few investor Q&A sessions this month to answer any questions on this buyout offer. Do sign up if you have not done so via this link.

Sales Updates

- In line with the team’s strategy to reposition Leedon Heights as a premium project in Sen Sok, the developer effected an increase in unit prices across all towers in April 2022.

- As expected, the team had seen a slowdown in sales in the past quarter due to the price increase, but they are confident that the announcement of Phase 3 of the Leedon Integrated Lifestyle Hub and the economic recovery of Cambodia would allow the project to command a higher price point by H1 next year.

- Feel free to follow the project’s facebook page to get an inside scope on the project’s latest marketing updates in Cambodia!

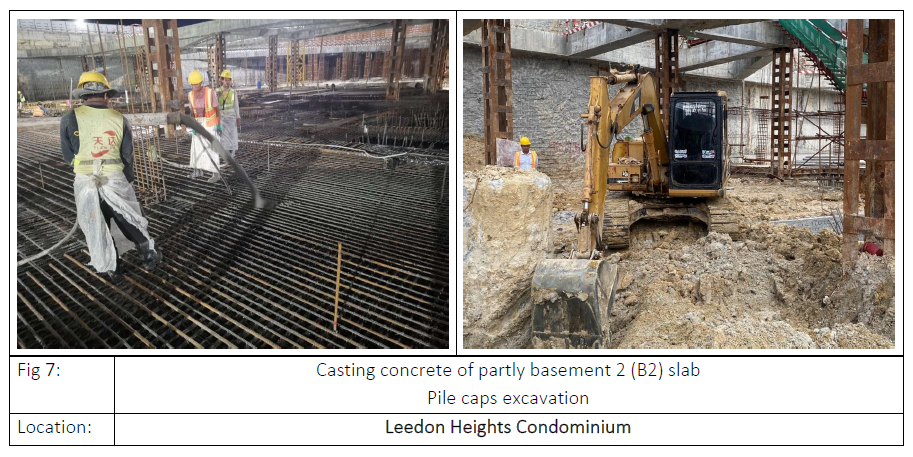

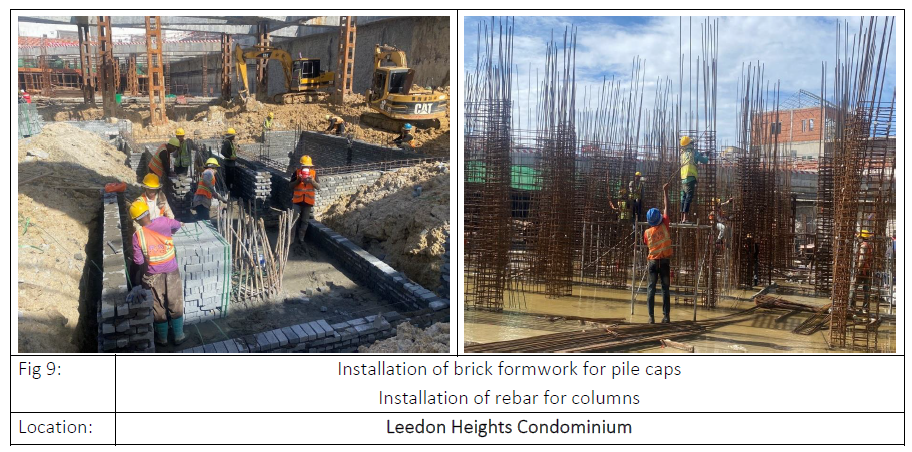

Construction Updates

- Construction is progressing as planned in accordance with the updated timeline.

- Estimated 50% of casting for B2 Column has been completed and is now undergoing reinforcement work.

- Estimated 80% of casting for B2 Slab with Pile Caps has been completed.

Construction Site Pictures

Project Milestones

Latest Economic Developments in Cambodia

Check out the latest articles featuring Cambodia’s development and growth to understand why investing in Cambodia will continue to have a place in your investment portfolio.

Aeon Mall (Cambodia) Co Ltd and Aeon (Cambodia) Co Ltd will open its third shopping mall Aeon Mall Meanchey on December 15 with an edutainment concept along Hun Sen Boulevard in the south of Phnom Penh, said a release. Full article here (Khmer Times).

The monthly Residential Property Price Index (RPPI) for Phnom Penh increased 1.8 percent in August this year compared to the same month of the previous year and 1.5 percent over to July this year after the index returned 0.4 percent in the positive area for the first time in June, according to the latest report of the National Bank of Cambodia (NBC). Full article here (Khmer Times).

With the rise in tourism numbers and as we head into the traditional busy tourist season, there are also an increasing number of potential investors and property buyers venturing to Cambodia over the coming months Full article here (Khmer Times).

The Ministry of Public Works and Transport said that four companies were given an in-principle agreement to undertake feasibility studies on the construction of an expressway between Phnom Penh to Siem Reap province, home of the famed Angkor Archaeological Park. Full article here (Khmer Times).

Fund Description: Compounder Fund is an open-ended fund that focuses on long-term investing in public equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Progress

2022 was a choppy year for stocks as quantitative tightening around the globe resulted in stock prices falling. As of 30th November, the S&P 500 index was down 11.7%. Compounder Fund was down 39.2% as high-growth stocks were more heavily sold down due to the greater impact that discount rates have on cash flows that will be generated later in the future.

But valuations aside, we remain optimistic that the companies in the portfolio can come out of the looming recession stronger than before. In fact, from a fundamental standpoint, the companies in Compounder Fund’s portfolio have performed valiantly even amid the global macro slowdown and high inflation rates. The fund’s portfolio companies grew revenue at an average rate of 27%, 19.6% and 19.6% in quarters one, two and three of 2022 respectively.

The macroeconomic environment is challenging as we enter 2023, but our companies remain in a strong position to weather this storm as most of our companies either already have positive cash flow, are close to profitability, or have plenty of cash on hand. It is also worth mentioning that many of our companies have begun to prioritize the generation of cash flow over chasing growth in these uncertain times. This will mean that revenue growth will decelerate, but it will increase cash flow and cash on hand – these will help our companies tide through any tough period.

Overall, at these valuations, and with continued prudence and good execution from our portfolio company’s management teams, we believe the fund is well positioned for good long-term returns.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Galilee Investment Fund VCC - Sub-Fund 1

Real Estate Debt Fund

Fund Description: Real Estate Debt Fund is an open-ended fund that focuses on sourcing out good quality assets which require debt funding, giving investors the opportunity to participate in specific projects of their choice. The Sub-Fund will invest primarily in real estate backed private or public fixed income products or deals. The Sub-Fund aims to provide investors with a stable annual dividend income yield of between 6-10% net of fees, paid out quarterly, over the long term.

Fund Progress

The first project launched for this Fund is structured as a Hospitality Fit-Out Debt Financing with an expected dividend payout of 7.5% per annum, paid quarterly with a 2-year term. This project allows investors to participate in providing debt financing for the fit-out of a series of hospitality developments to be managed by international brands such as Hilton, Citadines, Park Royal and Fraser Hospitality.

You can find a copy of our Project Factsheet here.

Click here or contact investor_relations@galileeinvestment.com if you wish to find out more!

Capri @ 228 (To be managed by Fraser Hospitality)

The first hospitality development, Capri@228 has completed a mock-up room Fraser’s approval. The soft launch and grand opening of the property will be expected to take place in the Q1 2023.

Global Tech Exchange (To be managed by Hilton)

The second project in this portfolio is Hilton Hotel at Global Tech Exchange. Construction is postulated to be completed by H1 2023. Fit-out works for the hotel will commence in Q2 2023 and is expected to be completed in Q2 of 2024.

Contact us

Kindly email us at investor_relations@galileeinvestment.com or contact your usual Galilee contact if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.)

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions.