Q4 Investors' Newsletter

October 2021

Message from Our COO

Lawrence Lim, COO,

Galilee Investment

Management

Dear Investors,

As we enter into the final quarter of the year, I certainly wish that Singapore can quickly and successfully move past both the Stabilization and Transition phases into the new normal with COVID as we exit 2021. My prayers continue to go out to Singapore and our neighbours in the region as we carefully navigate through the uncertainties brought about by this pandemic.

We would like to assure you that Galilee will continue to bring value to our investors and we have a few exciting developments that we hope to share with you.

Firstly, we have plans underway to increase our engagement with our investors through a series of webinars/seminars on a variety of finance-/investment- related topics starting early next year.

Next, we would also like to update that the registration of our new Variable Capital Company (VCC) Fund is underway. A VCC is a new company structure specially designed for collective investment funds set up in Singapore, with many added benefits as compared with current fund structures. Find out how a VCC structure benefits investors here. There is also a 70% grant scheme to offset the costs of setting up a VCC to encourage adoption of this new structure. Our VCC will feature two new sub-funds with very different strategies. One would be a real estate backed debt fund and the other would be a special opportunities strategy trading in public equities.

We would definitely love to hear your feedback on these new initiatives through a short survey which would take less than 2 minutes. You can access the survey by clicking on the button. Thank you.

Lets begin with the fund-specific updates for Cambodia Development Fund.

Project Updates

The situation in Cambodia seems to be stabilizing. As of 15 September, almost 60% of the population has been vaccinated, placing them second after Singapore in terms of vaccination rate among the Southeast Asian Nations and within top 30 in the world. In fact, Phnom Penh became the first capital to attain 99% vaccination rate among their adult population in August. Our consultant had also feedback that most of the team working (including construction workers) on the project had gotten their 3rd booster vaccination jab in Cambodia. Is the worst over? It remains to be seen. Nevertheless, both sales and construction fronts are progressing well.

In July, the sales team conducted a thorough review of the sales strategy and one of the key objectives was to maintain the overall project’s profitability and IRR for our investors. This meant that reducing the prices or giving deep discounts were out of the question. The sales team concluded that the best option was to increase the selling price of the remaining units of Tower 1, 3 and launch the first 20 floors of Tower 5. After the team effected the new strategy in early August, we have seen a decent pick up in sales momentum. As of 31 August 2021, 84% of Tower 1 and 71% of Tower 3 has been sold/booked. Of the 171 units launched for Tower 5, 17 units had been sold.

The overall construction timeline had seen a accumulated delay of about 3 month due to a number of factors but was mainly due to (1) material shortage and shipping delay and, (2) imposed curfews due to COVID over the past few months. Due to these delays, the team also had to intentionally postpone the soil excavation phase of the basement construction to avoid the need for costly dewatering due to the rainy season from May to October. Nevertheless, the development team had provided for an amended timeline to catch up on the delay at later stages of the development so there would be little effects on the final completion date, scheduled for Q4 of 2023.

The sales and development teams continue to adapt to the ever-changing situation and challenges along the way. Do read the detailed sales and construction updates in the next section.

Fund Audit Updates and Project Valuation Report

The first full audit for the fund for FY2020 is in its final stages of review. An ‘As if Complete’ and cost valuation was also conducted by CBRE for the purpose of the audit. We are reasonably confident that the final audit would pass without any significant findings.

Moving on to the Compounder Fund.

The Fund achieved a 25.0% total return net of fees (correct as of 31 August 2021) since inception, which translates into a 21.8% annualized return. Ser Jing and Jeremy continues to monitor and stick closely to the investment process set out for the fund to sieve out and invest in great businesses for the fund. As always, Ser Jing and Jeremy has published their portfolio’s investment theses on their website and you can access them here.

With that, I would thank you for your patience and continued support. Please feel free to reach out to us if you have any feedback. That is all from me but please read on for more detailed updates for each fund in next sections.

Regards

- VCC is a new legal entity form / structure for all types of investment funds in Singapore. It can be formed as a single standalone fund, or as an umbrella fund with two or more sub-funds, each holding different assets.

- VCCs are MAS-regulated and is required to be managed by a registered or licensed fund management company in Singapore.

- VCCs must be audited annually.

- A VCC has a variable capital structure that provides flexibility in the issuance and redemption of its shares.

- VCCs can pay dividends out of capital, which gives fund managers flexibility to meet dividend payment obligations.

- Each sub-fund under an umbrella VCC will have segregated assets and liabilities.

- Cost efficiencies from using common service providers across the umbrella and its sub-funds will potentially translate into more returns for investors.

- A VCC can be used for both open-ended and closed-ended fund strategies.

- Privacy of shareholders are protected since shareholders list do not need to be made public.

Click Below to Scroll straight to your specific fund's update

Fund Description: The Fund was created to achieve a target annual compounded return of 18% net of fees through investment in residential real estate development in Cambodia. This closed-ended fund started in January 2020 and is targeted to close no later than December 2024. The target fund size is US$37 Million.

Fund Updates

- The first full audit for the fund for FY2020 is in its final stages of review.

- An ‘As if Complete’ and cost valuation was also conducted by CBRE for the purpose of the audit.

- The team is reasonably confident that the final audit would pass without any significant findings.

Sales Updates

- To maintain profitability and the target IRR for investors, the sales team revised the pricing up for the remaining units of Tower 1 and Tower 3 in August.

- The sales team also decided to launch the first 20 floors of Tower 5.

- Although this was an unusual move amid a soft sale environment, the team believes that the quality and location of the project deserved to be repriced on the back of increasing land prices in Sen Sok district.

- Even after the repricing exercise, we have seen an increase in sales momentum for both foreign and local sales in August and September.

- As of 31 August 2021, 84% of Tower 1 and 71% of Tower 3 has been sold/booked. Of the 171 units for Tower 5 launched, 17 units had been sold.

- Feel free to follow the project’s facebook page to get an inside scope on the project’s latest marketing updates in Cambodia!

Construction Updates

- Construction continues with delays from the original schedule of about 3 months.

- This delay was the accumulated effect of several factors including (1) COVID curfew due to lockdown, (2) a delay in material delivery due to shortages in the past few months and, (3) intentional postponement of soil excavation till towards the end of the raining season months (May -Oct).

- The development team has provided us with a catch-up schedule which institutes for the project to catch up to the original timeline by the end of Q4 of 2023.

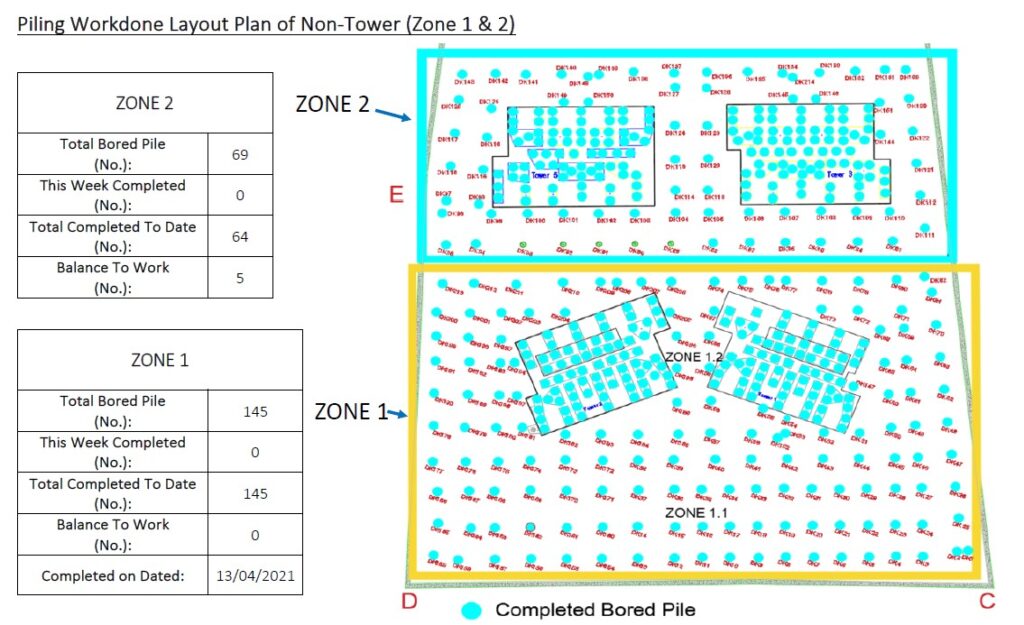

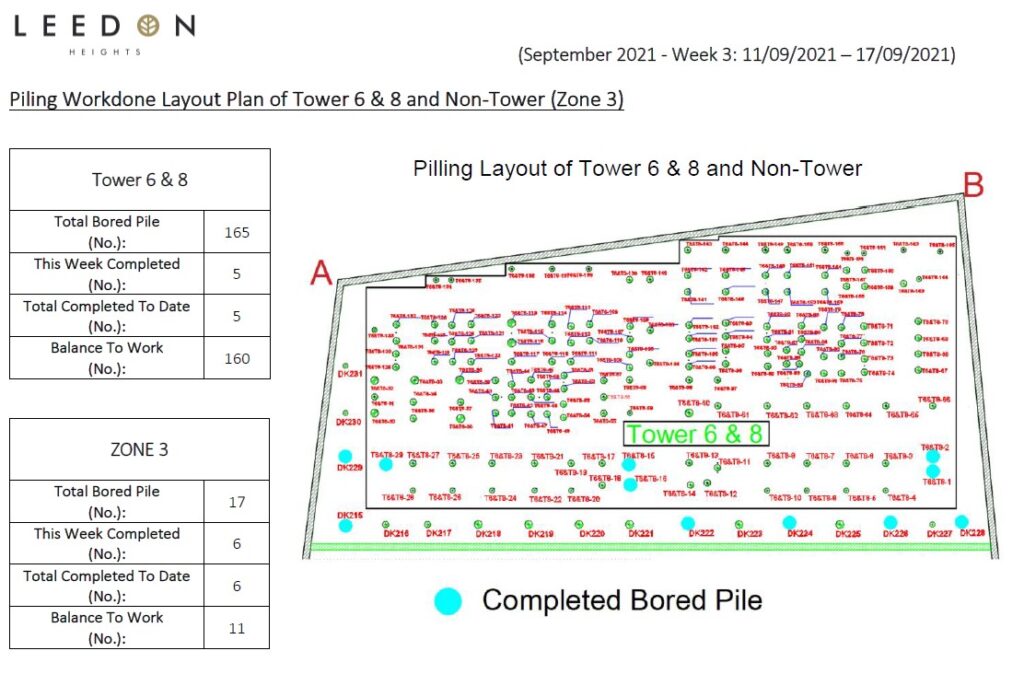

- 100% of the concrete casting and drilling of bored piles for the first 4 residential towers are completed less 5 piles in Zone 2 due to blockage which would be completed at a later stage. Piling for Zone 3 (Tower 6 and Tower 8) has also commenced.

- About 30% of the capping beam has been completed and soil excavation has commenced.

- On-going static load testing of bored piles.

- Basement structure for the whole development is projected to be completed by Q2 2022.

Project Milestones

Construction Site Pictures

Latest Economic Developments in Cambodia

Check out the latest articles featuring Cambodia’s development and growth to understand why investing in Cambodia will continue to have a place in your investment portfolio.

Despite the context of COVID-19, the new Phnom Penh Airport is about 25 percent complete. Full article here (Khmer News).

The article provides a perspective about the future prospects of trade and tourism for Cambodia. Full article here (Khmer News).

“The vast lands of Sen Sok swept through this month’s popularity rising from 5th overall to be the 3rd most popular district due to a spike in interest. Its flatlands continue to make it a popular development choice for many looking to capitalize on the Kingdom’s persistent pace of growth.” Full article here (Khmer News).

The new Law on Investment aims to attract more local and foreign investors by protecting their rights. Full article here (Khmer News).

“Due to the physical geographic boundaries surrounding Phnom Penh, expansion into the south is inevitable. With large scale infrastructure development ongoing, the south’s pre-eminent position is clear,” said CBRE Cambodia Managing Director James Hodge. Full article here (Khmer News).

Cambodia will host the region’s biggest sports event from May 5 to 17, 2023. Full article here (Khmer News).

China’s Foreign Minister Wang Yi reaffirm strong ties with the Kingdom, citing vaccine support and sports stadium gift for hosting the SEA Games, and signed a cooperation agreement to continue infrastructure building in the country during his visit. Full article here (Phnom Penh Post).

Fund Description:

Compounder Fund is an open-ended fund that focuses on long-term investing in equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Progress

The companies in Compounder Fund’s portfolio continue to produce great business results. In the second quarter of 2021, the average year-on-year revenue growth for all of the Fund’s holdings that have reported their latest quarterly results (as of the date of this letter’s drafting, 13 September 2021), was 52.5%. It’s worth noting that this performance came on the back of average revenue growth of 36.6% for the same set of companies in the second quarter of 2020. The average free cash flow margin in the second quarter of 2021 for the companies did decline to 16.1% from 19.0% a year ago. But the excellent revenue growth meant that Compounder Fund’s portfolio holdings, in aggregate, still produced pleasing free cash flow growth. Looking at these numbers, the Fund is on the right path toward good long-term returns.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Giving Back...

In line with Galilee’s vision and mission to give back to the community, we have been working with our affiliate partners, a Family Care Centre and New Encounter Worship (NEW) Ministry to support the less fortunate through a few initiatives. The Family Care Centre is missioned to protect and serve women and children who are victims of domestic violence, regardless of race, culture or religion. The Centre can provide temporary accommodation for up to 100 women and their children. Galilee will be sponsoring some of the Centre’s initiatives such as the Live Well Programme and the Five Loaves and Two Fishes Programme.

The Live Well Programme is a savings program which aims to teach and encourage the children of the beneficiaries to save. For every $1 that each child saves, the programme matches a $1 in their savings.

The Five Loaves and Two Fishes Programme is a meal programme for the beneficiaries at the Centre in the form of claimable meal vouchers at the coffee shops and hawker centres within the Centre’s vicinity.

Additionally, Galilee is also supporting a new online grocery platform initiative started by Nice Mart Pte Ltd and YouLiiv Pte Ltd, which is currently under development. This initiative would allow needy families to conveniently order what they need from the online platform and have them delivered, once it goes live.

In the Pipeline...

As updated, Galilee has triggered for the registration and set up of a new VCC structure, tentatively called Galilee Investment Management VCC, to incorporate 2 new sub-funds with different strategies. We would definitely love to hear your views. Please help us complete this quick survey which would take less than 2 minutes.

Note: This is the same survey as the one above. Please ignore if you have completed it. Thank you.

Contact us

Kindly email us at enquiry@galileeinvestment.com if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.)

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions.