Q3 Investors' Newsletter

July 2021

Message from Our COO

Lawrence Lim, COO,

Galilee Investment

Management

Dear Investors,

I am delighted to share this quarter’s update with you. As you can see, we have decided to bring a new look and format to our newsletter and website. We have also decided to host all future newsletters on our website, similar to what you are seeing here to improve readability and incorporate more engaging content within each newsletter to you directly.

We have also made improvements to our Newsrooms Page to include upcoming events, announcements, and direct links to our partners’ websites so you can keep yourselves updated on the latest happenings relating to our funds. You can still access fund-specific updates via the Subscriber Access Page where we archive the fund’s documents, newsletters, and other live updates on our funds!

Let me begin on the key fund-specific updates starting with Cambodia Development Fund.

COVID’s Impact on Sales and What The Fund is Doing to Manage It

The volatile state of the pandemic situation has had all three of our sales centres (Cambodia, Singapore, and Taiwan) on partial lockdowns since Q4 last year. Additionally, other developers are resorting to extending large discounts to compete on price, hence creating a buyers’ market. Expectedly, unit sales for the project have experienced a slowdown despite continued marketing efforts.

To tackle this challenge, the major decision to delay Tower 2’s and Tower 5’s sales launch for another year (until mid-2022) was made, to focus the marketing efforts on selling off the remaining lower-level units of Tower 1 and Tower 3 first. The rationale is straightforward. Given the current climate, the market is offering a lower price than what the project is worth. Therefore, spending substantial marketing dollars on a sales launch of Tower 2 and Tower 5 now would certainly not yield the desired sales results.

This decision would enable the project to remain cashflow positive by channeling construction costs toward completing Tower 1 and 3 first, and hence, resolving the need to reduce the pricing to compete with other developers.

Engagement with Singapore Real Estate Agencies

In our last quarterly newsletter, we updated that the project was amid finalising ERA’s engagement to commence selling Leedon Heights in Singapore. In fact, the final contract was sent to ERA for their signing on 1st April 2021 after several rounds of discussion.

Unfortunately, ERA pulled the plug on 5th April 2021, stating that they would be delaying the signing until further notice without providing a reason. To be clear, ERA did not pull the contract off the table completely and could resume the signing in future. Nevertheless, the Fund has decided not to actively pursue them until they are ready to proceed.

Concurrently, the Fund has also been pursuing another 2 reputable sales agencies in Singapore. In fact, top management from both agencies had already given their in-principal approval to proceed, and are currently in discussion with them. We will keep you updated.

Fund Audit Updates and Project Valuation Report

Due to the lockdown in Cambodia, the Fund’s auditors have been forced to put off the physical office visits part of their fieldwork. Concurrently, the Fund has also engaged CBRE Cambodia to conduct an “As if Complete” and cost valuation as required by the auditors to finalise the financial statement calculations.

As expected, the first audit for the JV entity and the Fund will usually take longer as the project’s finance team sort through initial alignment with the auditors to smoothen the audit process for the current and subsequent years. A deadline extension request has been made with ACRA to submit the Fund’s fully audited financial statements and the finance team is aiming to have the audit completed by Q3 of this year.

Moving on to the Compounder Fund.

The Fund has successfully raised S$1.72M in the previous subscription round in April and S$2.765M in the latest window closed on 30 June 2021. This is a strong testament of the continued trust in the Fund’s mandate by new and existing investors. The Fund has achieved a 9.2% return (correct as of 31 May 2021) since inception on 13 July 2020. By now, you should know that the Fund always take every opportunity to reemphasize that it was created to generate an annual net return of 12% or more over the long run, (five- to seven-year period or longer) and require your continued support to take a long-term investment horizon view of at least 3 years to potentially see outperformance. This is based upon the team’s firm belief that a stock will do well eventually if its underlying business does well. But over the short-term, a stock’s price can fluctuate wildly, without much connection to the performance of the underlying business.

We are also pleased to update that the Fund has successfully completed its first audit without any issues. As usual, Ser Jing (Fund Manager of Compounder Fund) would be sending you the Fund’s quarterly investors’ letter later this month. The letter will discuss a myriad of investing topics, including details on the Fund’s portfolio.

With that, I would thank you for your patience and continued support. Please feel free to reach out to us if you have any feedback. That is all from me but please read on for more detailed updates for each fund in next sections.

Regards

Click Below to Scroll straight to your specific fund's update

Fund Description: The Fund was created to achieve a target annual compounded return of 18% net of fees through investment in residential real estate development in Cambodia. This closed-ended fund started in January 2020 and is targeted to close no later than December 2024. The target fund size is US$37 Million.

Insights on COVID’s Impact on Our Project

More than one year on and the world is still not out of the woods. No one could have imagined the severity and extent of this pandemic when it first started, and it has undoubtedly wreaked havoc on many businesses and the way of life that we are so used to.

COVID Situation (Cases and Vaccinations) in Cambodia

The total number of COVID cases in Cambodia ballooned to almost 50,000 cases in June 2021 from just 366 cases in 2020. The government was quick to initiate a 3-week lockdown in Phnom Penh starting on April 15th to keep the cases under control.

As seen in Chart 1, the lockdown measures were effective in slowing the increase and eventually saw daily cases start to drop. Unfortunately, the lockdown had caused severe hardships in “red zones” where people were banned from even leaving their homes to purchase food and aid was not forthcoming. This led to pressure on the Government to end the measures prematurely, leading to the daily cases increasing again from the middle of May.

Fortunately, the situation seemed to have stabilized in June. One key reason could be due to the increase in vaccinations administered. Cambodia was the first country in Southeast Asia to receive 324,000 doses of AstraZeneca vaccines on 3 March 2021. They also received more than 6 million doses of Sinovac and Sinopharm vaccines since February 2021. More than 2.2 million Cambodians and foreigners in Cambodia have already been vaccinated (as of 9 June 2021) and the health ministry aims to complete their vaccination campaign in Phnom Penh by July 2021.

This is great news for the project team, with normalcy to steadily resume in the Capital within the next quarter.

COVID’s Impact on Phnom Penh Residential Market and Leedon Heights

COVID has not changed the initial investment thesis of the Fund in the longer-term (~3 years). Although COVID has dented many demand factors in the immediate term, affecting sales and the perceived value of our development, the project team remains confident that the project, with its premium location and well-thought masterplan, will continue to command better valuation than what the current market is offering today. This is one of the key reasons why the project team has decided to delay the sales launch of Tower 2 and Tower 5 till mid-2022.

The Fund tracks several demand factors such as GDP growth, infrastructure spending, foreign direct investments, income growth and population growth; and supply factors such as land prices and new condominium project launches to monitor if there are any major shifts from our initial thesis. Forecasts remain robust for 2021 and beyond for Cambodia, especially Phnom Penh. A few factors will be highlighted in this update, starting with some demand drivers.

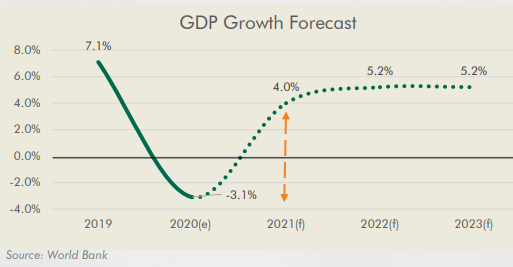

Chart 2: Cambodia GDP Growth Forecast

GDP growth forecast stands at 4% growth in 2021 and more than 5% growth in 2022 (Chart 2). This is expected since the Cambodian economy is very dependent on its tourism industry. This sector would not recover for another year at least until travel resumes back to pre-COVID levels. However, we are confident that once travel resumes, tourism would recover quickly, bringing GDP growth to a pre-COVID level of an average of 6-7%.

Population in Phnom Penh is projected to continue to grow by at least 3% annually for the next 5 years (Chart 3). Population growth is known to be directly proportionate to the demand for housing. As more local Cambodians migrate from the provinces to the city to look for work, they would also need a place to stay. The is one of the key drivers for housing demand in Phnom Penh, apart from foreign investments.

Cambodian Income levels are projected to rise at a compounded annual growth rate of 5.5% (Chart 4) for the next 5 years. This also mean that a higher percentage of Cambodians would be able to afford apartment housing in the capital.

Also as highlighted in our previous newsletter, the Government continues to spend more than US$8 billion into infrastructure building in time for the 2023 SEA Games to be held in Phnom Penh.

Moving on to the supply factors. As land gets increasingly scarce in the city, supported by rising land prices even through the pandemic, landed property is no longer as affordable in the city. The next best option would be to purchase a condominium apartment.

Chart 5: Construction Projects In Phnom Penh (By Start Date and Status)

New Condominium Projects under construction had dropped drastically in 2020 and 2021 (updated as of April 2021) as seen in Chart 5, after peaking in 2018 and 2019. This is good news for buyers of the project as the new supply released into the open market would be constricted in 3-4 years’ time. That is when Leedon Height is expected to be completed.

In summary, the long-term demand factors seem to continue to outstrip supply factors. Due to these reasons, it is justifiable to believe that condominium prices will resume its upward trend within the next 2 quarters. Even in Q1 2021, Chart 6 illustrates an uptick in condominium prices across all segments.

Chart 6: Condominium Prices (By Segment)

COVID’s Direct Impact on Leedon Heights

- On the sales front, the lockdowns in Cambodia, Singapore, and Taiwan, has dampened sales to a near halt in the last quarter.

- On the construction front, there was less of an impact on the progress since the construction workers are being quarantined onsite to ensure work progress.

Sales Updates

- The sales teams are concerting all their sales efforts to sell the remaining lower level units of Tower 1 and 3 in Cambodia, Singapore, and Taiwan.

- As highlighted, the Fund has also made the decision to delay Tower 2 and Tower 5 sales launch till next year to manage the project cashflow and aim for a better climate to launch, and receive a better response and result.

- The team is also pursuing 2 other reputable sales agencies to represent Leedon Heights sales in Singapore. The Fund will release more information once an agreement has been signed.

- Due to the lockdown, the sales teams have pivoted online in a huge way! Check out some of the many videos in Chinese, English and Khmer featuring the project to attract new investors and home buyers!

Construction Updates

- To manage construction costs, the project management team has renegotiated our payment schedule to focus on the construction of Tower 1’s and Tower 3’s civil structures first, after completing the basement carpark for the entire 2 hectares of land. This would help accelerate progressive payment collection from the buyers and smooth out construction costs over time.

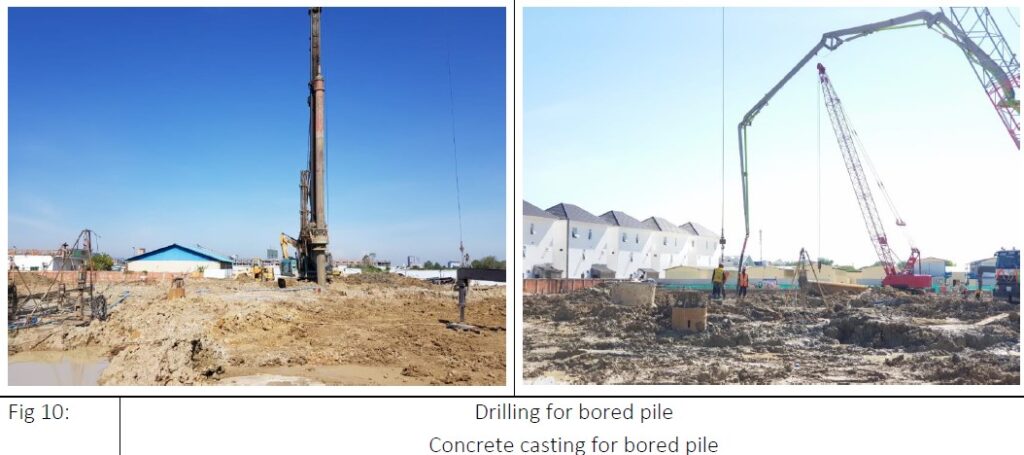

- Concrete casting and drilling of bored piles for all 4 residential towers are about 80% complete.

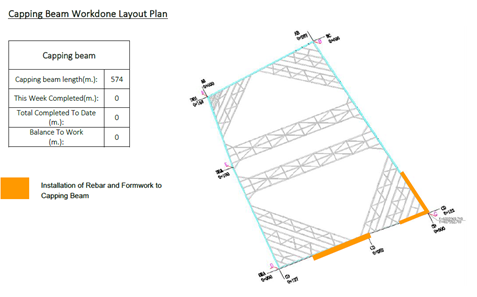

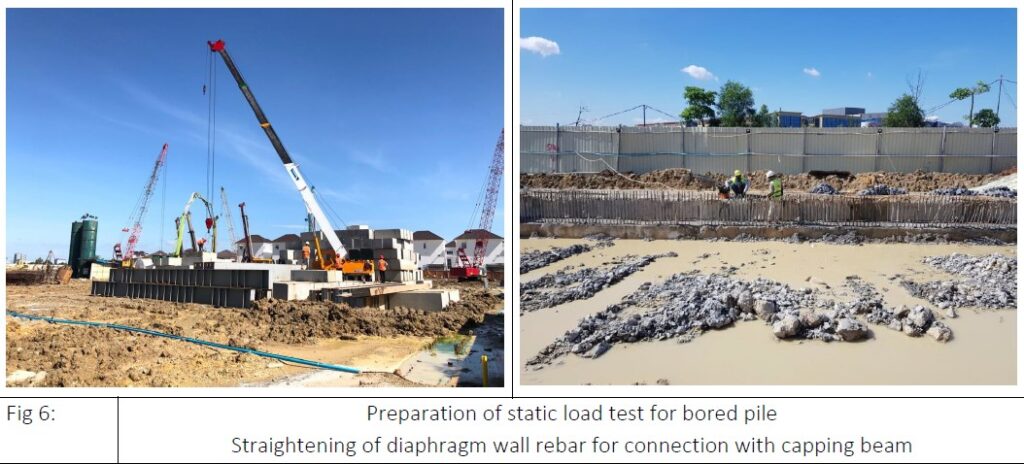

- Commencement of Capping Beam works in June 2021. This is in preparation for the commence of basement excavation.

Construction Site Pictures

Project Milestones

Fund Description:

Compounder Fund is an open-ended fund that focuses on long-term investing in equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Progress

The business performances of Compounder Fund’s holdings based on their average revenue growth and free cashflow margin improvements over last year have been excellent. In the first quarter of 2021, the average year-on-year revenue growth for all of the Fund’s holdings that have reported their latest quarterly results (as of the date of this letter’s drafting, 16 June 2021) was 57.3%. This performance was not the result of a rebound in fortunes after a poor showing in the first quarter of 2020 – in fact, the average year-on-year revenue growth in the first quarter of 2020 for the same set of companies was more than 30%. Apart from excellent revenue growth in the first quarter of 2021, the free cash flow margin (free cash flow as a percentage of revenue) also improved from an average of 13.7% a year ago to 18.4%. Looking at these numbers, the Fund is on the right path toward good long-term returns.

Kindly email us at enquiry@galileeinvestment.com if you have any questions, comments or changes to your personal details. (Bank account, handphone, email address, residential address etc.)

In the Pipeline...

As a follow on update on our potential new VCC fund, Galilee is currently in consultation with our clients and advisory committee to iron out the potential terms and structure. In addition, we are drawing up the timeline for the launch based on the presence of a set of critical launch conditions to better protect the interests of our potential investors. We assure that you will be the first to hear once a decision has been made.

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions.