Q1 Investors' Newsletter

January 2025

Galilee Investment Management

Message from CEO

Mr. Joseph Ong,

CEO

Dear Investors,

As we step into 2025, I would like to extend my heartfelt gratitude to each of you for your unwavering support and trust in Galilee. Your partnership has been instrumental in shaping our journey, and I am excited to embark on this new chapter together.

Reflecting on 2024, it was a year of significant achievements and milestones for Galilee. Notably, we were proud to secure our Capital Markets Services (CMS) License, transitioning from a Registered Fund Management Company to a Licensed Fund Management Company – a pivotal step in our growth journey. Additionally, we successfully onboarded a new Variable Capital Company (VCC) Fund, further broadening our portfolio and enhancing our capabilities. Our team has also grown stronger with the addition of a Portfolio Manager and a Legal & Compliance Manager, reflecting our dedication to building a robust foundation for sustainable growth.

Looking ahead, 2025 promises to be an exciting year. Our commitment remains steadfast in continuing to identify new investment opportunities, monitor our existing investments and fostering deeper partnerships.

Lastly, we are delighted to welcome Mr. Ho, who joined Galilee on 1 January 2025 as a Portfolio Manager. He will oversee the Asia Tech Fund VCC, bringing a wealth of experience and strategic vision that will undoubtedly add value to both Galilee and the fund.

Mr. Ho Der Chyn, Portfolio Manager

Mr. Ho brings over two decades of diverse experience across industries, specializing in financial management, operational efficiency, and process optimization. His last position was to serve as Finance Director at a local company, where he focused on enhancing financial processes and ensuring compliance with industry standards.

Previously, he contributed to public sector initiatives at the Ministry of Health, where he supported healthcare process improvements and health advocacy programs. Additionally, as the founder of a reprographics business, he worked closely with clients in niche sectors such as architecture and construction, where he was able to foster strong professional relationships with his business partners, while delivering tailored solutions on demand.

A graduate with a Bachelor of Science in Management Studies, Mr. Ho views practicality and adaptability are what defines him and his past contributions across the various fields of work.

Vision Investing: Beating the Market & Changing the World

We are pleased to introduce the Vision Investing Course, a cohort-based program designed to equip investors with the skills and mindset to achieve sustainable, long-term returns while aligning their investments with personal purpose and values.

Led by Eugene Ng, founder and portfolio manager of Vision Capital Fund, the course provides participants with a structured framework to enhance their investment approach. Key topics include:

- Constructing a winning investing mindset that can be employed immediately.

- Building your own solid framework to swing the odds of successful investing in your favour.

- Understanding and owning businesses.

- Investing as a lifelong passion.

Eugene brings extensive professional and personal experience to the course, having consistently outperformed market benchmarks over seven years of managing Vision Capital.

The upcoming cohort will run from February 18 to March 6, 2025, featuring live interactive sessions, practical case studies, and lifetime access to course materials. Participants will also have the opportunity to engage directly with Eugene and connect with a community of like-minded investors.

For more information or to enroll, please visit Vision Investing Course on Maven. Note that all Galilee Investors can enjoy a 20% off on the course fees by entering the promo code “VISION20” when checking out.

That is all from me but do read on for fund specific updates. We would like to thank you for your patience and continued support. Please feel free to reach out to us if you have any feedback.

Regards,

Joseph Ong

fund Specific updates

Galilee Investment Fund VCC - Sub-Fund 1

Galilee Fixed Income Fund

Fund Description: Galilee Fixed Income Fund is an open-ended fund that focuses on sourcing out good quality assets which require debt funding, giving investors the opportunity to participate in specific projects of their choice. The Sub-Fund will invest primarily in real estate backed private or public fixed income products or deals. The Sub-Fund aims to provide investors with a stable annual dividend income yield of between 6-10% net of fees, paid out quarterly, over the long term.

Fund Updates

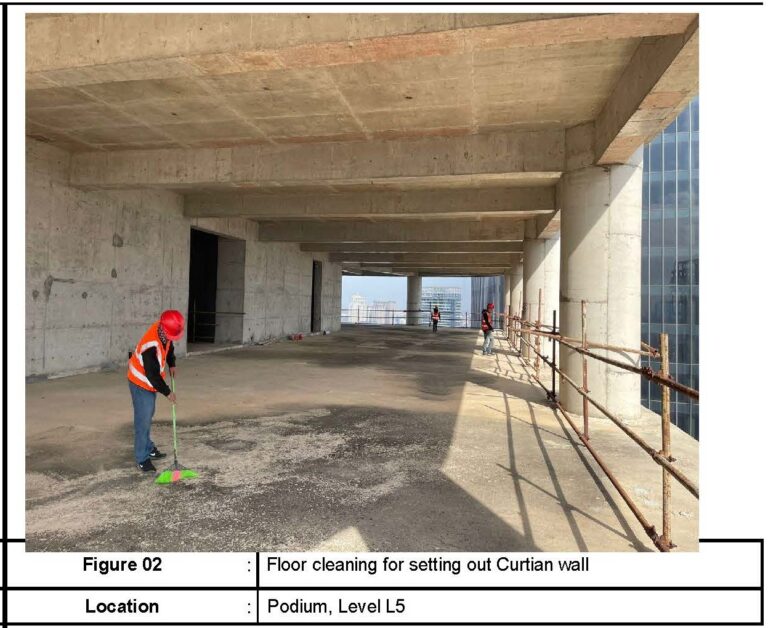

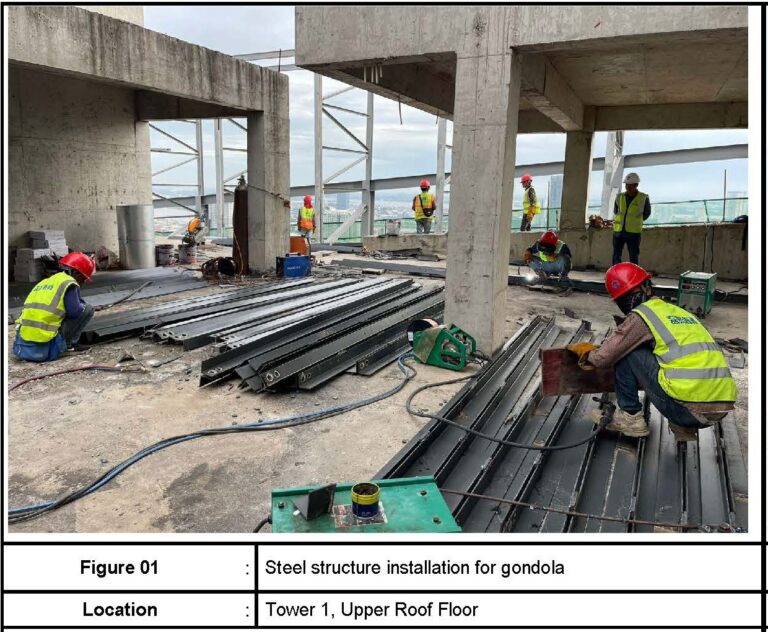

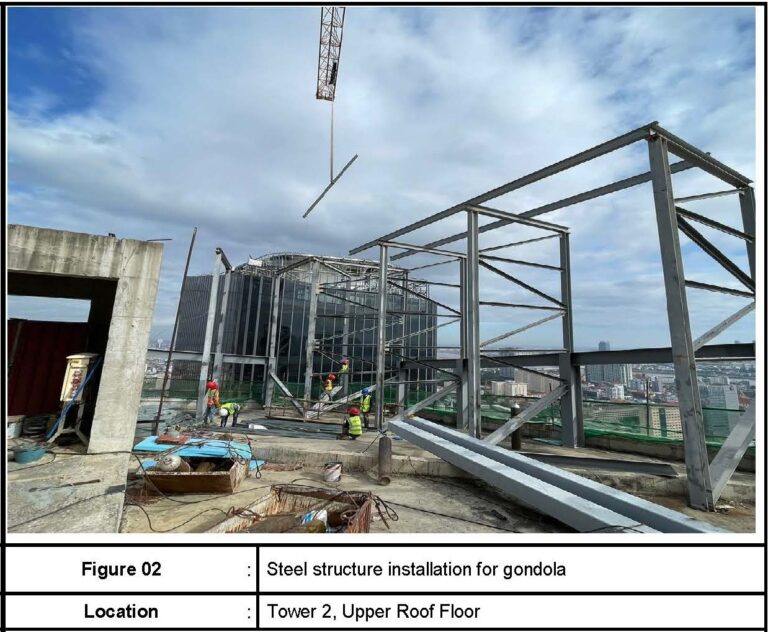

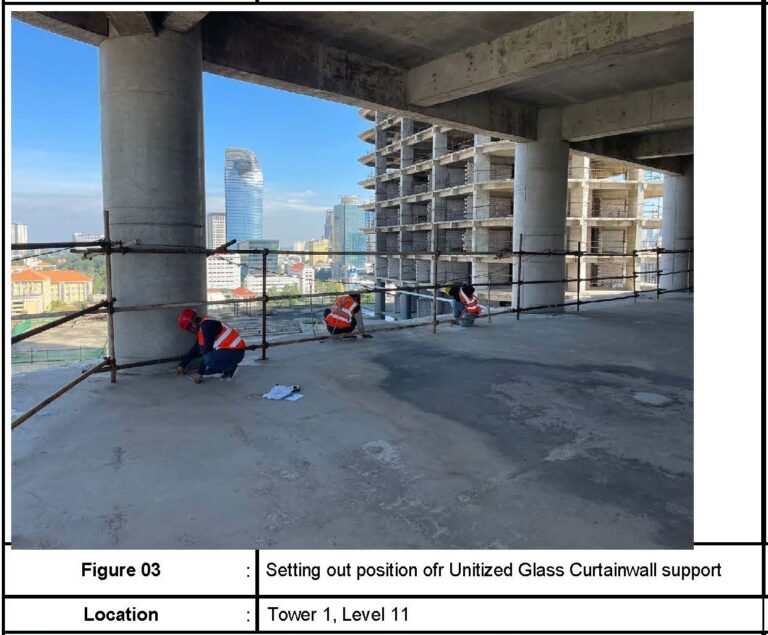

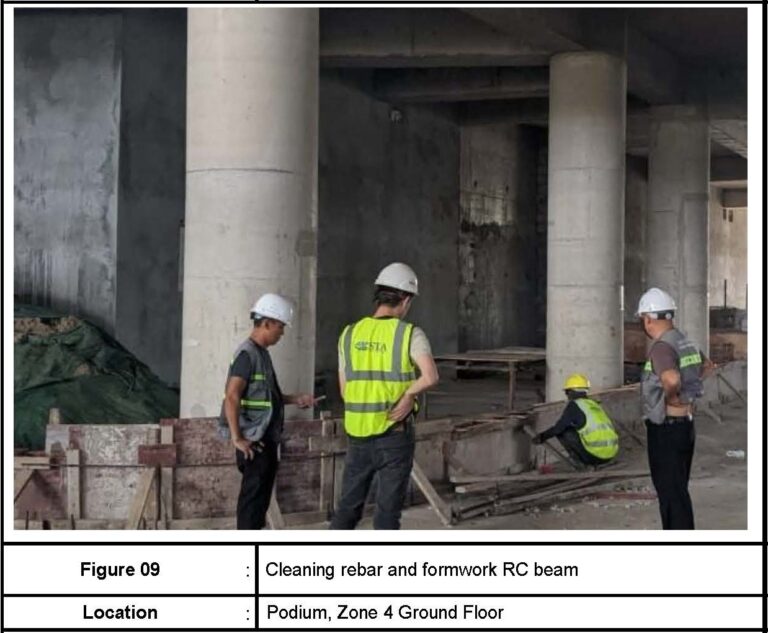

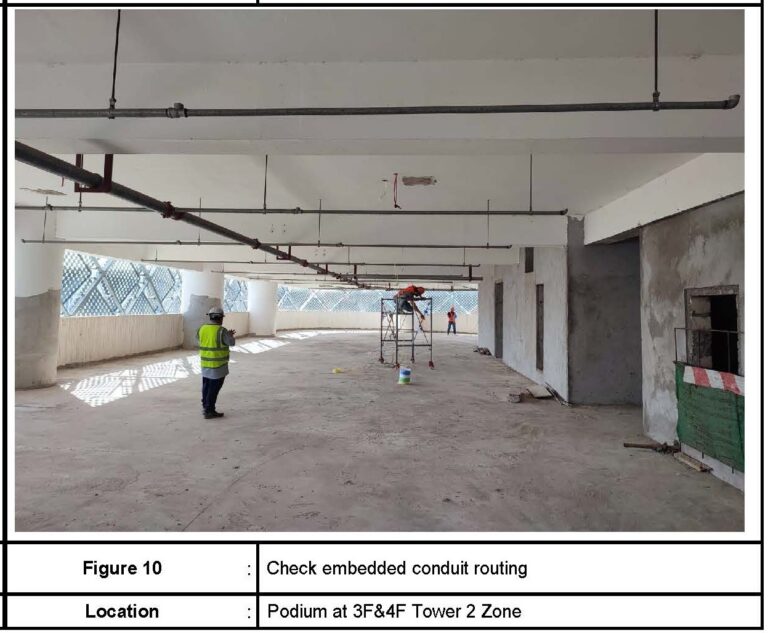

Global Tech Exchange Status Updates

As updated during our investor update sessions in December, the shareholder restructuring process had been successfully completed, and construction had resumed on 1 December 2024.

Click here or contact investor_relations@galileeinvestment.com if you wish to find out more!

Latest Economic Developments in Cambodia

Check out the latest articles featuring Cambodia’s development and growth to understand why investing in Cambodia will continue to have a place in your investment portfolio.

To address current real estate challenges and support the National Housing Policy of the Ministry of Land Management, Urban Planning, and Construction (MLMIPC), Banking and Financial Institutions (BFIs) in Cambodia Friday agreed to consider reducing interest rates on housing development and real estate purchases. Full article here (Khmer Times).

According to the annual report from the Ministry of Land Management, Urban Planning and Construction (MLMUPC), released in November 2024, Cambodia’s construction sector attracted nearly US$80 billion of investment capital over 24 years from 2000 to 2024. Full article here (Khmer Times).

There is a target from the Royal Cambodian government to map and have all land titles approved and issued over the next few years, and although the Ministry of Land Management, Urban Planning and Construction (MLMUPC) has implemented digitalisation improvements. Full article here (Khmer Times).

The real estate sector in Cambodia has undoubtedly been affected by external factors and the global economy, while foreign direct investment and the growth of tourism are also contributing factors. Full article here (Khmer Times).

Fund Description: Compounder Fund is an open-ended fund that focuses on long-term investing in public equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Updates

As of 31st November 2024, the fund’s earliest series for its Class A shares is up 29.8% year-to-date compared to the S&P 500 index which is up 30%. Since inception on 13 July 2020, the aforementioned series is up 11.3% compared to the S&P 500 index which is up by 97.2%.

US stocks in general continued their upward trend in the fourth quarter of 2024 with the S&P 500 hitting fresh all time highs in November. US markets continue to outperform the global stock market. Outside of the US, China stocks had a tough quarter, losing some of their gains from earlier this year.

From a portfolio perspective, Compounder Fund exited Cassava Sciences after the company reported disappointing Phase III results for its Alzheimer’s disease drug candidate, simufilam. Cassava Sciences is an early-stage biotechnology company that was researching a potentially groundbreaking drug (simufilam) for Alzheimer’s disease that showed excellent Phase II results. Unfortunately, with the poor Phase III results, hopes of a near-term FDA approval for the drug have extinguished. We completely sold out Compounder Fund’s position in Cassava Sciences in late-November.

Besides Cassava Sciences, other companies in Compounder Fund’s portfolio posted positive results, in aggregate, for 2024’s third-quarter. Notably, our biggest position in the portfolio, Meta Platforms, delivered another quarter of stellar results, with revenue up 19% year-on-year in the third quarter of 2024, and free cash flow up 18% with a 40% free cash flow margin. As of 22 December 2024, Meta’s stock price, excluding dividends, is up 65% year-to-date.

Overall, we continue to believe that most stocks in the fund’s portfolio look reasonably priced and we are optimistic about their long-term business futures.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Fund Description: The Fund was created to achieve a target annual compounded return of 18% net of fees through investment in residential real estate development in Cambodia. This closed-ended fund started in January 2020 and is targeted to close no later than December 2024. The target fund size is US$37 Million.

Fund Updates

The process of striking off the company is currently underway, with a target completion in the first half of 2025.

VC VISION CAPITAL VCC - Sub-Fund 1

Vision Capital Fund

Fund Description: Vision Capital Fund is an open-ended fund that focuses on long-only global equities. This fund aims to deliver superior, sustainable, compelling long-term (over five years and more) returns for investors by investing in the stock market, specifically in quality, durable, and innovative compounders, riding secular tailwinds that can grow profitably and durably well for a long time at high rates of returns.

Fund Updates

The fund had the best possible start we could ask for thus far this year, as we continued to outperform strongly all major indices on a gross and net basis. Thus far, we have deployed most of our capital across twenty-six stocks. We have written eleven in-depth investment memos of our holdings, all available to our investors on our website. In addition to adding new investors to the fund, we also have had several existing investors add follow-on capital to their initial subscription. Our immediate focus is to complete the writing of the remaining investment memos in the months ahead. We are excited to share our first annual letter next month.

Lastly, we will teach our third Vision Investing live online course, lasting approximately 3 weeks from mid-February to early March 2025, across six 2.5-3 hours modules. Net proceeds from the course are invested in the Vision Give Back Fund, where 20% of the annual gains are donated to philanthropic causes into perpetuity. More details will be shared separately, and interested investors (subscribers of Vision Capital Fund)and their families can join the live Zoom sessions for free.

If you wish to find out more, please contact eugene.ng@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Contact us

Kindly email us at investor_relations@galileeinvestment.com or contact your usual Galilee contact if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.) Kindly also inform us if you cease to be an Accredited Investor under the SFA at any time.

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Galilee makes no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio given changing market conditions. Please consult a professional investment consultant prior to making any investment decision.