Q1 Investors' Newsletter

January 2022

Message from Our Management

Joseph Ong (Left), CEO &

Lawrence Lim (Right), COO,

Galilee Investment

Management

Dear Investors,

On behalf of the Galilee team, we would like to wish you and your family a blessed Christmas and a fruitful and prosperous new year. 2021 had been a rollercoaster year. With the pandemic raging, many have been constrained by the chaotic challenges but others have demonstrated the best of human resilience to not only adapt to these same challenges but to emerge stronger with changes & innovations. The team at Galilee has been hard at work doing the latter to deliver greater value and returns for your existing investments with us and expand our investment product offering to serve your needs.

We are pleased to update that we have incorporated two new umbrella funds namely, Galilee Investment Fund VCC and My Square Metre Fund VCC, under the Variable Capital Company (VCC) scheme. A VCC is a new company structure specially designed for collective investment funds set up in Singapore, with many added benefits as compared with current fund structures.

The Galilee Investment Fund VCC is an open-ended investment fund established to provide a cost effective launchpad for budding, but talented and passionate, investment professionals to focus on the execution of their fund investment strategies. The umbrella fund will feature two sub-funds with different strategies at launch. One would be a project-based real estate backed debt fund and the other would feature a special opportunities strategy trading in public equities. My Square Metre Fund VCC is also an open-ended investment umbrella fund which will allow investors to participate in My Square Metre’s (Galilee’s strategic partner) growing real estate portfolio in Cambodia through one of its sub-fund.

The sub-funds will be launched progressively by Q3 this year. Do contact us if you wish to find out more!

Moving on to the fund-specific updates for Cambodia Development Fund.

Vaccinated Travel Lane (VTL) between Cambodia and Singapore was finally opened on 16 December 2021. Unfortunately, ticket sales were paused shortly after due to the threat of the new COVID variant. Nevertheless, the team is looking forward to return to Cambodia once ticket sales resume on 20 January 2022. In addition, the team hopes to also resume investor tours to Cambodia to view the current progress of the development and other new projects.

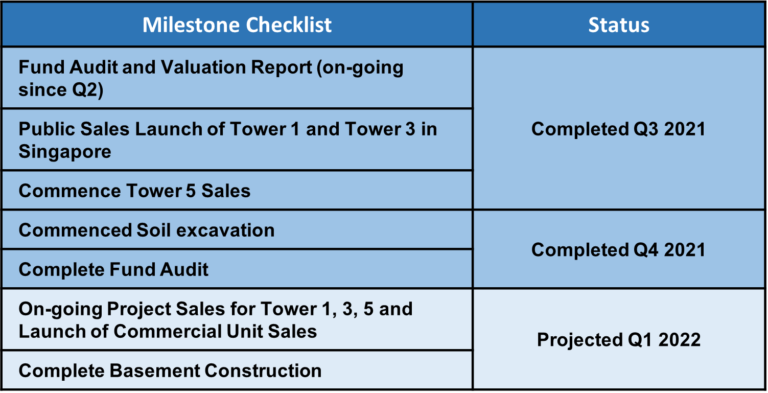

The sales team continue to gain momentum in Q4 of 2021 even with the price increase. Almost 17% of Tower 5 has been sold/booked as of 30 November 2021, since its launch in August. Of the 3 towers which has been launched (Tower 1, 3 and 5), 57% has already been sold/booked. The construction team has also been pushing ahead to catch up with the construction schedule ahead of the Chinese New Year break. The construction is still on track for completion by Q4 2023. Do read the detailed sales and construction updates in the next section. We are also pleased to update that the first full audit for the fund and the joint venture entity for FY2020 has been completed and signed without any findings.

Now for Compounder Fund.

The Fund achieved a 17.35% total return net of fees (correct as of 30 November 2021) since inception, which translates into a 12.71% annualized return. Ser Jing and Jeremy continues to monitor and stick closely to the investment process set out for the fund to sieve out and invest in great businesses for the fund. As always, Ser Jing and Jeremy has published their portfolio’s investment theses on their website and you can access them here.

With that, we would like to thank you for your patience and continued support. Please feel free to reach out to us if you have any feedback. That is all from us but please read on for more detailed updates for each fund in next sections.

Regards

Giving Back...

The past year continue to be tough for many people around the world due to the prolonged pandemic, and devastating floods affecting our neighbours, Malaysia and Philippines. The team at Galilee is grateful for our abundance and is privileged to be able to give back to those who are less fortunate around us.

As an update from our last newsletter, Compounder Fund had since contributed a total of S$2500 to the Five Loaves and Two Fishes Programme. Galilee has also committed to contribute S$5150 in online grocery gift cards through the Blessed Groceries Project, to needy families in Singapore. In addition, Compounder Fund has also pledged 10% of their annual profits to charity and the initiatives mentioned above.

Click Below to Scroll straight to your specific fund's update

Fund Description: The Fund was created to achieve a target annual compounded return of 18% net of fees through investment in residential real estate development in Cambodia. This closed-ended fund started in January 2020 and is targeted to close no later than December 2024. The target fund size is US$37 Million.

Fund Updates

- The first full audit for the fund for FY2020 is completed. The team is pleased to announce that the final audit was passed without any findings.

- A profit of US$855,346 was recognized, translating into a NAV of US$1.10/share.

- The results from the audit report will be reflected in the upcoming quarterly NAV report as of 31 Dec 2021.

Sales Updates

- The decision to launch Tower 5 was well received. 17% of Tower 5 has been sold/booked within 3 months of launch.

- The launch was marked by a dinner event that was held at the project’s showroom. Watch the highlights here: https://fb.watch/a1lbPsviDO/

- The team continues to be successful in repositioning Leedon Heights as a premium project in Sen Sok especially with the potential announcement of Phase 3 of the Leedon Integrated Lifestyle Hub upcoming this year. This will allow the project to command a higher price point.

- As of 30 November 2021, 57% of the 3 towers which has been launched is sold/booked.

- Feel free to follow the project’s facebook page to get an inside scope on the project’s latest marketing updates in Cambodia!

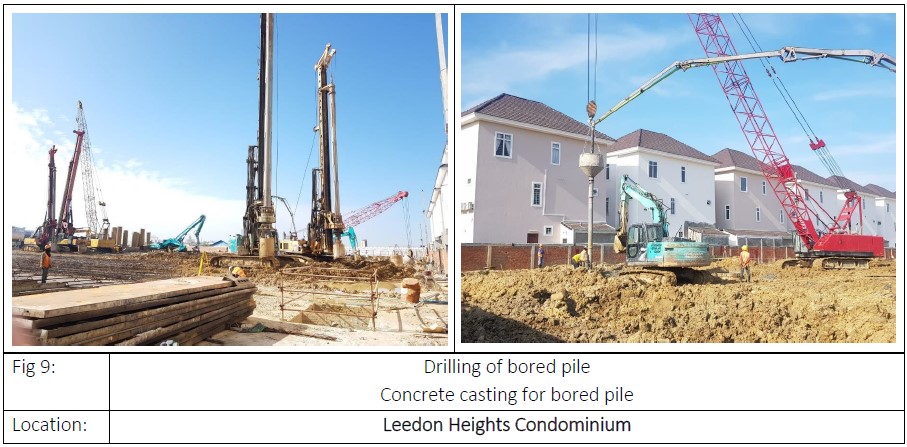

Construction Updates

- Construction continues as scheduled, projected to be completed by the end of Q4 of 2023.

- Piling for all 3 Zones has been completed.

- Soil excavation has been progressing as planned. Zone 1 has achieved a excavation depth of 3.5m.

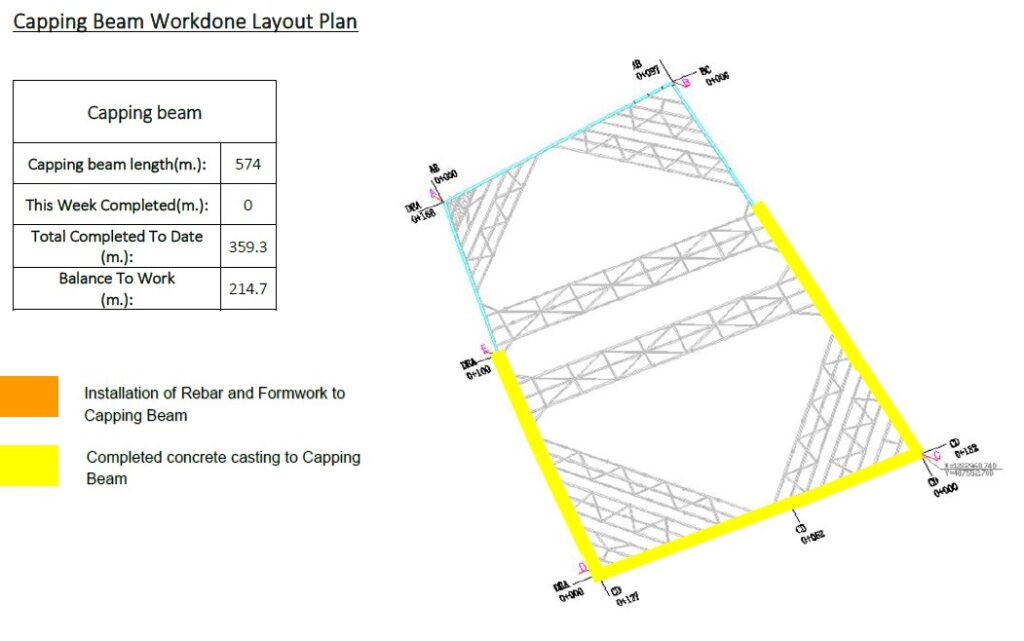

- Capping Beam for Zone 1 and 2 has been completed.

Construction Site Pictures

Project Milestones

Latest Economic Developments in Cambodia

Check out the latest articles featuring Cambodia’s development and growth to understand why investing in Cambodia will continue to have a place in your investment portfolio.

Despite the context of COVID-19, the PP-Sihanoukville Expressway is about 70 percent complete. Full article here (Khmer News).

Property developers are looking to gradually increase prices in the next 12 months following the country’s economic reopening. Full article here (Khmer News).

“Cambodia’s ‘raging’ property boom could soon be back, with the country slowly recovering from the adverse effects of the COVID-19 pandemic.” Full article here (Khmer News).

Promising tourist numbers increase could be the start of a slow recovery of the tourism, hospitality and restaurant sectors. Full article here (Khmer News).

The main drivers of GDP growth in 2021 are the garment sector, non-garment sector, agriculture sector, and real estate sector. Full article here (Khmer News).

Fund Description:

Compounder Fund is an open-ended fund that focuses on long-term investing in equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Progress

The companies in Compounder Fund’s portfolio continue to produce great business results. In the third quarter of 2021, the average year-on-year revenue growth for all of the Fund’s holdings that have reported their latest quarterly results (as of the date of this letter’s drafting, 21 December 2021), was 40.8%. It’s worth noting that this performance came on the back of average revenue growth of 45.8% for the same set of companies in the third quarter of 2020. The average free cash flow margin in the second quarter of 2021 for the companies did decline to 16.4% from 20.0% a year ago. But the excellent revenue growth meant that Compounder Fund’s portfolio holdings, in aggregate, still produced pleasing free cash flow growth. Looking at these numbers, the Fund is on the right path toward good long-term returns.

On the Web and in the News...

We are also pleased to be able to share our investing thoughts with the public through interviews and articles. Our wish is to have investors’ and the public gain more knowledge about investing. Here are a list of interviews/articles that we have done over the past one year!

05 Jan 21 – Asiaone – 6 things I’m certain will happen in the financial markets in 2021.

7 Feb 21 – DollarAndSense – 5 Questions With Chong Ser Jing

6 May 21 – MoneyFM 89.3 – Why Investing In Stocks Is a Lot Like Lending Your Friend Money

30 Jun 21 – Business Times – How to Invest Through High Inflation

15 Jul 21 – Compounding Curiosity – Writing into Running a Fund

More recently, we are also collaborating with iFAST to create investing related content for a new initiative called iFAST TV.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

In the Pipeline...

We are pleased to update that we have incorporated two new funds namely, Galilee Investment Fund VCC and My Square Metre Fund VCC, under the Variable Capital Company (VCC) scheme. A VCC is a new company structure specially designed for collective investment funds set up in Singapore, with many added benefits as compared with current fund structures.

The Galilee Investment Fund VCC is an open-ended investment fund established to provide a cost effective launchpad for budding, but talented and passionate, investment professionals to focus on the execution of their fund investment strategies. The Fund will feature two sub-funds with different strategies at launch. One would be a project-based real estate backed debt fund and the other would feature a special opportunities strategy trading in public equities. My Square Metre Fund VCC is also an open-ended investment umbrella fund which will allow investors to participate in My Square Metre’s (Galilee’s strategic partner) growing real estate portfolio in Cambodia through one of its sub-fund.

The sub-funds will be launched progressively by Q3 this year. Do contact us if you wish to find out more!

Contact us

Kindly email us at enquiry@galileeinvestment.com if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.)

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions.