Q3 Investors' Newsletter

July 2024

Galilee Investment Management

Message from CEO

Mr. Joseph Ong,

CEO

Dear Investors,

I am excited to share some substantial developments and exciting progress we have achieved over the past quarter.

It is with great pride that Monetary Authority of Singapore (MAS) has granted approval for our application to become a Licensed Fund Management Company (LFMC), to carry out fund management for accredited or institutional investors only (A/I LFMCs). As committed by MAS, we will be issued a Capital Markets Services (CMS) license within the week of July 29, 2024.

This milestone marks a significant step forward for our company, enabling us to expand our service offerings and offer our clients enhanced investment opportunities. Our team has diligently adhered to the stringent standards set by MAS, and this approval underscores our commitment to upholding the utmost integrity and professionalism in all aspects of our operations.

As part of our efforts to further strengthen our investment process and corporate governance, we are excited to promote one of our existing Portfolio Manager, Joshua Zeng, to take on a new role as Chief Investment Officer. In this new position, he will be responsible for overseeing the investment process and strategies across all our funds. We believe that with his leadership, our investment initiatives will continue to perform well and achieve strong results.

Mr. Joshua Zeng, Chief Investment Officer

While completing his Bachelors (Honours) of Economics programme at University College London (UCL) in 2018, Mr. Zeng and his former business partner started their investment journey, managing a private fund of £10,000 from their university tuition fees.

By God’s grace, his privately managed fund had achieved an annualised return of 53.36% net of all fees and taxes since inception, representing an amount of more than SGD4M at the point of the fund’s closure in January 2023. He also graduated from UCL with a First Class Honours in 2020.

After joining Galilee in June 2022, Mr. Zeng continued to develop his unconventional approach and strategy to investing where he seeks to identify inefficiencies and takes advantage of any gaps between market expectations and the probable reality. He looks for opportunities that offer skewed risk-reward profile with minimal absolute downside to achieve out-sized returns with little to no market influence over time.

Mr. Zeng’s passion and love for investing and his lifelong pursuit to become a better investor and an abiding allocator for God’s Kingdom was what urged him to first join Galilee and now, to contribute to the Company on a higher level.

Besides, we are thrilled to announce the forthcoming launch of a new Variable Capital Company (VCC) by our prospective strategic partner, which is currently in the pipeline. This VCC will primarily focus on investment strategies in public equities. Further information will be provied in our next quarterly newsletter once the VCC is officially incorporated.

That is all from me but do read on for fund specific updates. We would like to thank you for your patience and continued support. Please feel free to reach out to us if you have any feedback.

Regards,

Joseph Ong

fund Specific updates

Galilee Investment Fund VCC - Sub-Fund 1

Galilee Fixed Income Fund

Fund Description: Galilee Fixed Income Fund is an open-ended fund that focuses on sourcing out good quality assets which require debt funding, giving investors the opportunity to participate in specific projects of their choice. The Sub-Fund will invest primarily in real estate backed private or public fixed income products or deals. The Sub-Fund aims to provide investors with a stable annual dividend income yield of between 6-10% net of fees, paid out quarterly, over the long term.

Fund Updates

Celebrating Our 2-year Milestone

We are pleased to share some exciting updates as we mark the 2-year anniversary of the Galilee Fixed Income Fund. Since closing our first investment in July 2022, we have achieved significant milestones and delivered solid returns for our investors.

Successful Dividend Payments

Over the past two years, we have successfully paid out eight quarterly dividends payments both of our active projects, providing our investors with an annualized return of over 7.5%. This consistent performance underscores our commitment to delivering stable and attractive returns for our investors.

Inaugural Investment Tranche Redemption

We are proud to announce the successful redemption of the inaugural investment tranche from our investors who joined us in Project 1 in July 2022. This marks the first successful redemption executed since the fund’s inception, showcasing our capability to manage and execute redemptions efficiently.

New Project Launch

Following the success of our initial two projects, we launched a third project, Project 3 – 26HA Land Financing and managed to successfully achieve the fund raising target of above S$2M, all within the past four weeks.

We would like to thank you for your continued trust and support!

Click here or contact investor_relations@galileeinvestment.com if you wish to find out more!

Latest Economic Developments in Cambodia

Check out the latest articles featuring Cambodia’s development and growth to understand why investing in Cambodia will continue to have a place in your investment portfolio.

It is fair to say that the Cambodian property market continues to see a correction in mid-2024 and that the buyer profiles for condos and other properties on the market have changed over recent years. Full article here (Khmer Times).

While there was a slump in the real estate market post-Covid-19, 2022 and 2023 have shown signs of recovery. Land prices have gone up and the average land value in Phnom Penh stabilised to $4,500/sq metre in 2023, as per a report by the Cambodian Valuers And Estate Agents Association (CVEA). Full article here (Khmer Times).

With the number of condos and apartments increasing on the Cambodian market, especially in Phnom Penh, and a possible rebirth of Sihanoukville could be on the cards with the new strategic plans and inbound travel options rebounding, the rental market might be an area worth looking into – we have tried to bring some contemporary advice and tips into renting properties in Cambodia in 2024. Full article here (Khmer Times).

The south of Cambodia’s capital Phnom Penh is seeing some of the most drastic investment and urban change, much of it aligned to the potential opening of the new multi-billion dollar airport opening in 2025. Full article here (Khmer Times).

Fund Description: Compounder Fund is an open-ended fund that focuses on long-term investing in public equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Updates

As of 30th June 2024, the fund’s earliest series for its Class A shares is up 15.8% year-to-date compared to the S&P 500 index which is up 18.5%. Since inception on 13 July 2020, the aforementioned series is down 0.8% compared to the S&P 500 index which is up by 79.7%.

Stocks in general continued their upward trend in the second quarter of 2024. Potential rate cuts and positive economic data may be behind some of optimism in the markets.

From a portfolio perspective, Compounder Fund fully sold out its positions in Docusign and Etsy in June due to slowing growth and potentially more competition. The fund also trimmed positions in Costco and Chipotle due to stock prices reaching relatively higher valuations.

The proceeds from the sales were used to start a new position in Nu Holdings. Nu Holdings is a digital banking platform in Latin America that is growing its user base at a quick pace, whilst maintaining high profitability. We are also impressed with the culture set by management, who appear to be truly focused on building sustainable long-term value even at the expanse of short-term pain.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Fund Description: The Fund was created to achieve a target annual compounded return of 18% net of fees through investment in residential real estate development in Cambodia. This closed-ended fund started in January 2020 and is targeted to close no later than December 2024. The target fund size is US$37 Million.

Fund Updates

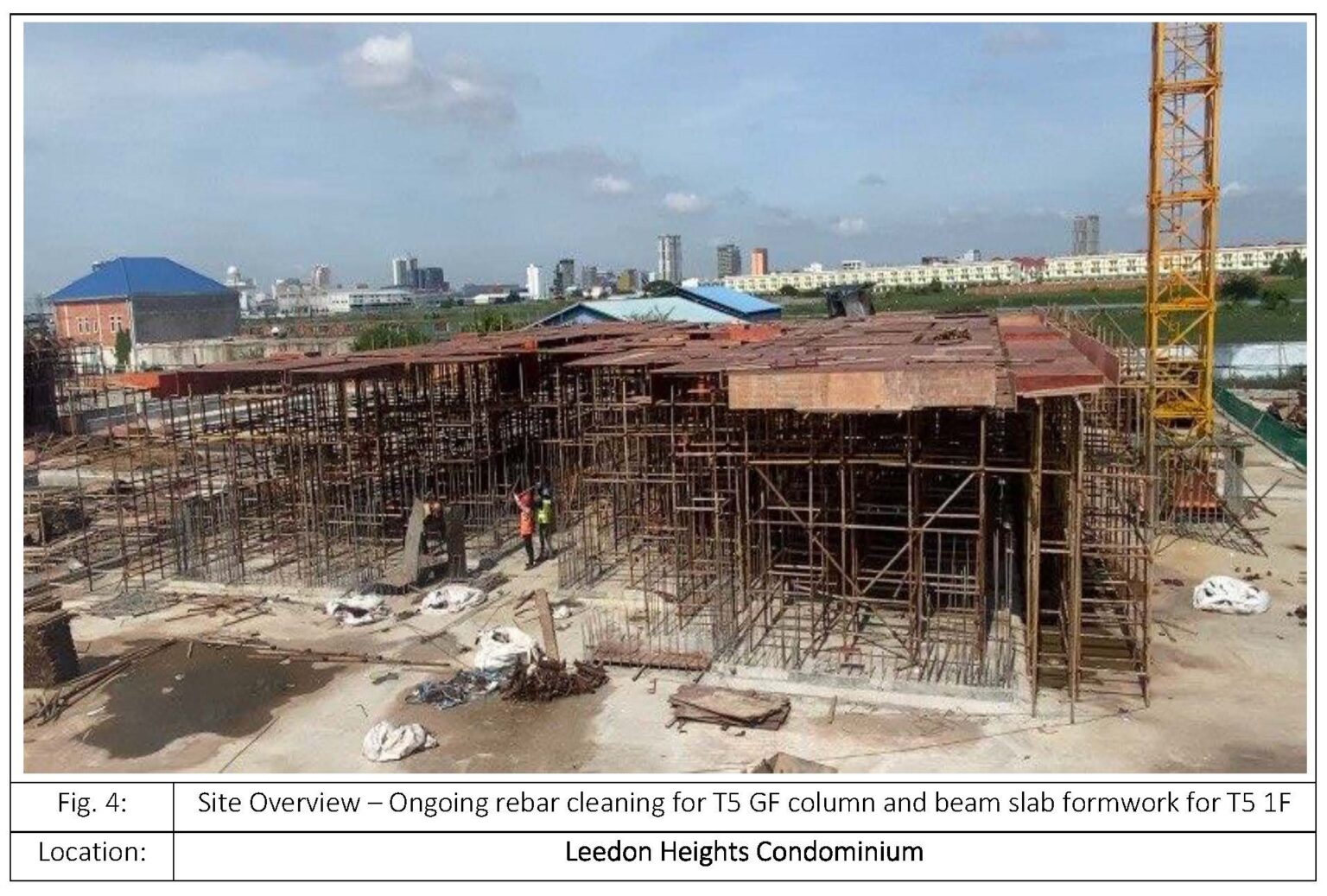

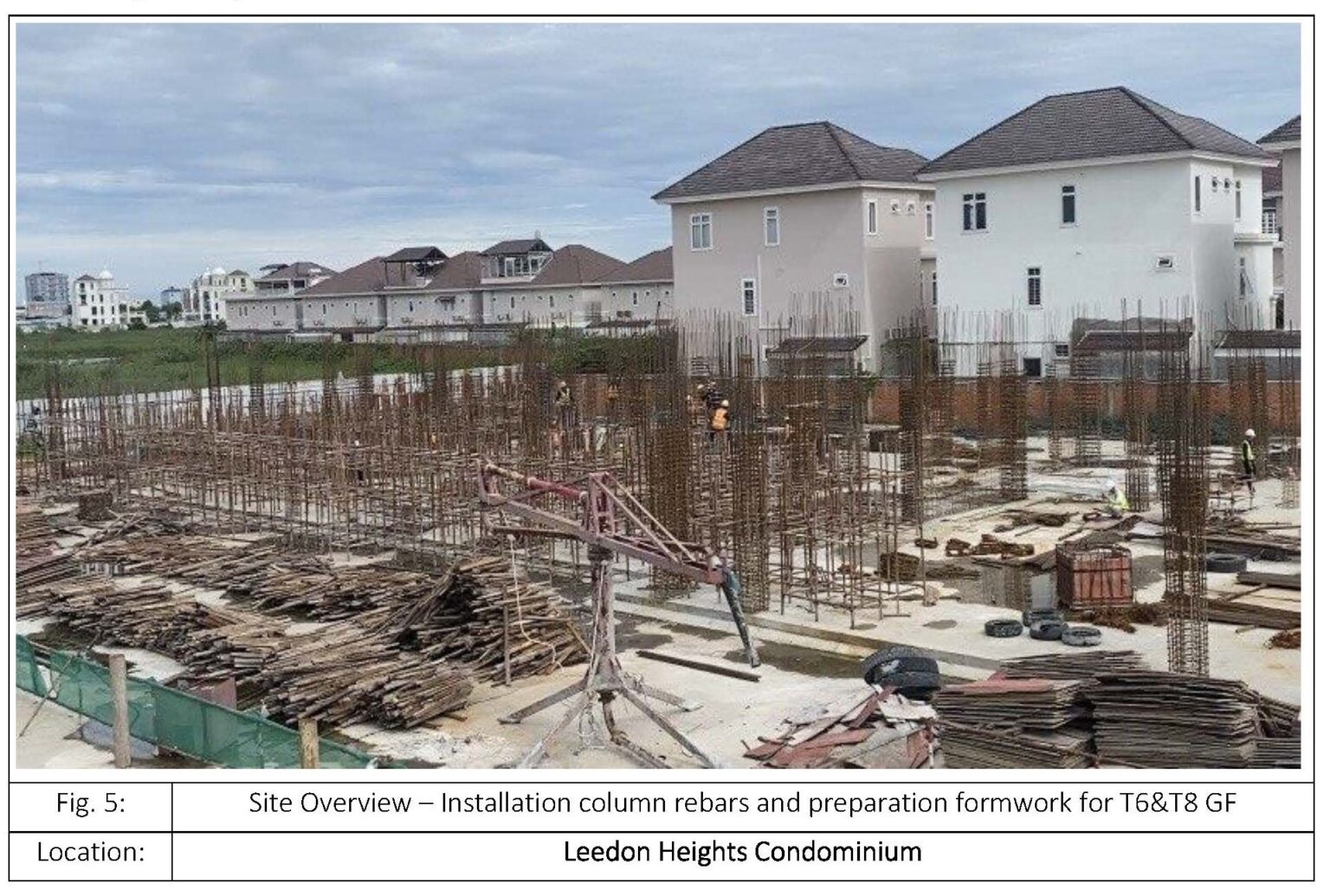

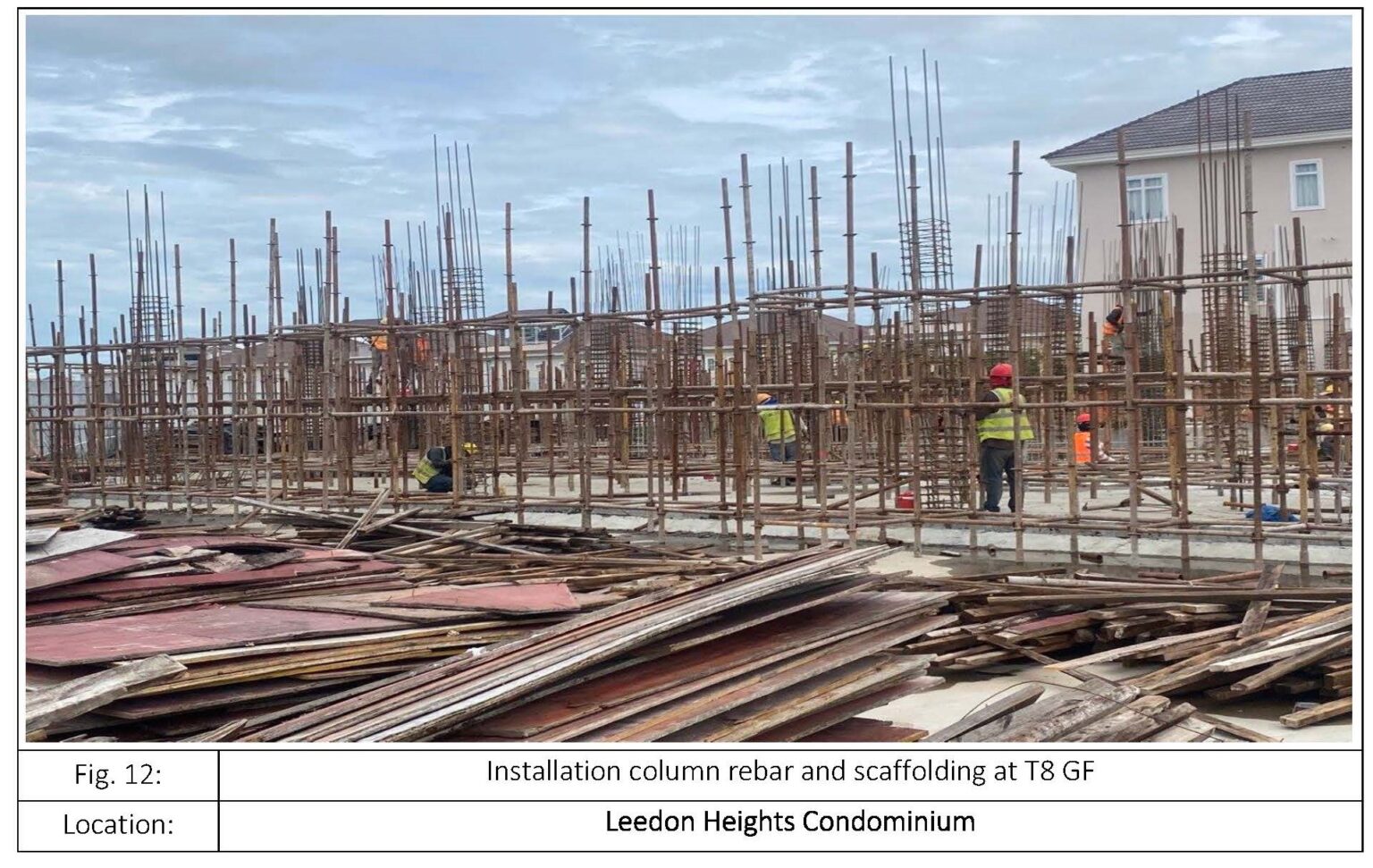

The Leedon Heights construction is progressing well. Check out the latest construction video and photo from the second week of July 2024.

Construction Site Pictures

Construction Site Video

Contact us

Kindly email us at investor_relations@galileeinvestment.com or contact your usual Galilee contact if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.) Kindly also inform us if you cease to be an Accredited Investor under the SFA at any time.

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Galilee makes no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio given changing market conditions. Please consult a professional investment consultant prior to making any investment decision.