Q4 Investors' Newsletter

October 2025

Galilee Investment Management

Message from Chief Executive Officer

Mr. Joseph Ong,

CEO

Dear Investors,

As we enter the final quarter of 2025, I am deeply grateful for the progress we have achieved together. All our funds — including those managed by our new Portfolio Manager overseeing the SMAs — delivered commendable performance in Q3. I will leave it to each team to share detailed insights in their respective fund updates. Our focus remains on strengthening our team’s competencies and capabilities through active knowledge sharing and continuous learning.

We also recently concluded Batch 3 of our Internship Programme, with Batch 4 commencing this month. Galilee continues to refine this initiative to ensure a mutually rewarding experience for both interns and the firm. This reflects our ongoing commitment to nurturing young talent, equipping them with meaningful industry experience, and leveraging their perspectives to drive our strategic initiatives. In the same spirit of purposeful growth, our sister organisation, Galilee Foundation, made a donation to the Cambodian Women’s Crisis Center (CWCC) on 24 July 2025 — reaffirming our vision of creating wealth with a higher purpose.

Looking ahead, we are in discussions with potential VCC partners to broaden our platform and enhance the value we deliver to investors. At the same time, we are exploring new opportunities in Cambodia with prospective partners, maintaining our focus on meaningful growth and impact. Thank you for your continued trust and support in Galilee. Together with our dedicated team, I look forward to achieving new milestones and delivering excellence in the journey ahead.

Do explore the fund-specific updates by clicking on the button below!

Donation to Cambodia Women's Crisis Center

Thank You for Making a Difference

We’re thrilled to share that Galilee Foundation, our sister organization, made a meaningful donation to the Cambodian Women’s Crisis Center (CWCC) on 24 July 2025 — made possible through your incredible support.

This timely contribution has brought much-needed help to one of CWCC’s shelters currently facing funding shortfalls. To everyone who participated — bidders, donors, artists, and volunteers — your support has created real impact to the local Cambodians in need and regional artists.

#GalileeFoundation #InvestingWithaHigherPurpose

Internship Programme: Batch 3 concluded; Batch 4 commencing in October

We extend our congratulations to Benjamin and Winston, who have successfully graduated from Galilee’s Internship Programme Batch 3!

Batch 3 ran from May till August (10-12 weeks period), where our interns participated in a structured programme designed to provide hands-on exposure to fund management, investment processes, and strategic business initiatives.

The internship program is divided into two key phases:

- Phase 1: Orientation and Training – This phase focuses on building foundational knowledge in fund operations, compliance, and internal workflows.

- Phase 2a: Attachment – This offers immersive rotations with our investment teams, including attachments with Galilee’s Fixed Income Fund, Vision Capital Fund, and the Compounder Fund.

- Phase 2b: Project and Implementation – This allows interns to undertake real-world projects such as developing an equities scoring model, enhancing compliance, supporting branding and PR efforts, event planning, operational automation, stock pitches, and much more

Both Benjamin and Winston performed exceptionally well in their assigned work scopes and projects! We thank them for their contributions and wish them all the best in their future endeavors.

We are right about to commence Batch 4! Looking forward to having a mutually rewarding experience.

Galilee Fixed Income Fund

Fund Description: The Fund adopts a diversified investment strategy focusing on sourcing and evaluating public and private fixed income products, specifically in areas of specialty financing, senior/subordinate real estate backed debt, factoring/trading financing, direct lending and corporate bonds, offered globally, to provide investors with a stable and consistent dividend yield through the market cycle.

Fund Updates

We are pleased to announce that since inception, the Galilee Fixed Income Fund has delivered a consistent annualized return of over 9%, with quarterly dividend payouts and no defaults across 13 consecutive quarters, highlighting our commitment to capital preservation and steady income generation.

Looking ahead, Galilee Fixed Income Fund will continue to deploy capital into Cambodia-centric investment opportunities over the next 12 to 24 months, where we continue to identify robust growth potential aligned with our target returns. We look forward to sharing details on several upcoming projects currently under evaluation.

Data Center Expansion

The Data Center, a fully constructed and operational asset located in Phnom Penh, Cambodia, forms a key component of the Global Tech Exchange Project and is operated by ByteDC Solutions.

We have identified compelling opportunities in Cambodia’s emerging data center leasing market, driven a Fit-Lease operational model. This model enables scalable deployment of infrastructure tailored to client requirements while optimizing operational efficiency.

A recent Memorandum of Understanding (MOU) signed with OREL IT. OREL IT is a global technology company. This strategic partnership, solidified at the ByteDC Solutions headquarters in Phnom Penh, is set to redefine the nation’s cybersecurity landscape by delivering premier, military-grade security solutions to the Cambodian market.

Manhattan Special Economic Zone (MSEZ)

The MSEZ is one of the operational Special Economic Zones in Cambodia, strategically located in Krong Bavet, a city in Svay Rieng Province near the border with Vietnam.

Recognising the growing demand for affordable housing in Cambodia, Galilee has identified promising opportunities within this emerging sector. We are currently exploring the development of an affordable housing project for local workers in MSEZ, where the need for quality and accessible homes is high. A Memorandum of Understanding (MOU) was recently signed between Galilee and MSEZ to collaborate on this potential initiative.

Addressing Cambodia’s Affordable Housing Gap

Cambodia’s housing market has grown rapidly, with most developments focused on mid- to high-end properties. However, many low- and middle-income citizens—such as factory workers, teachers, and civil servants—still struggle to access affordable homes due to rising construction costs and land prices.

To address this, the Ministry of Economy and Finance (MEF) established a Technical Working Group to promote affordable housing. The group coordinates tax incentives, streamlines approvals, and supports developers with infrastructure assistance such as roads and utilities.

These initiatives aim to make homeownership more attainable for local families and encourage developers to participate in affordable housing projects, helping to rebalance the market and meet Cambodia’s growing housing needs.

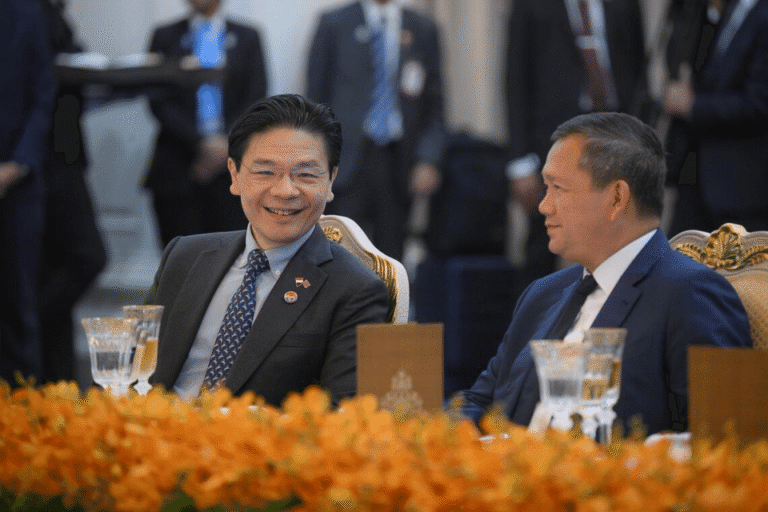

On 15 September 2025, Singapore and Cambodia commemorated 60 years of diplomatic relations. President Tharman Shanmugaratnam and Prime Minister Lawrence Wong sent congratulatory messages to King Norodom Sihamoni and Prime Minister Hun Manet, reaffirming the longstanding friendship between both nations.

President Tharman highlighted that Cambodia’s early recognition of Singapore’s independence laid the foundation for a relationship built on trust and mutual respect, strengthened over the decades through active engagement across many areas.

Prime Minister Wong also noted the steady growth of bilateral ties since 1965, particularly in trade, capacity building, digital transformation, and food security. He expressed confidence that the partnership will continue to flourish and deliver tangible benefits to the peoples of both countries, while looking forward to closer cooperation bilaterally and within ASEAN.

Click here or contact investor_relations@galileeinvestment.com if you wish to find out more!

Latest Economic Developments in Cambodia

The construction industry remains a vital engine of Cambodia’s economy, playing a crucial role in GDP growth and job creation. Full article here (Khmer Times).

After much fanfare, the Techo International Airport (KTI) commenced operations with Air Cambodia’s flight K6 611 from China to Phnom Penh on September 9, 2025. Full article here (Khmer Times).

Over the past few decades, Cambodia has undergone a significant demographic shift, characterised by steady population growth and rapid urbanisation. Full article here (Khmer Times)

Cambodia has undergone a significant digital transformation that has impacted nearly every sector of the economy, including the real estate sector. Full article here (Khmer Times).

Fund Description: Compounder Fund is an open-ended fund that focuses on long-term investing in public equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Updates

As of 30th September 2025, the fund’s earliest series of its Class A shares was up 5.4% year-to-date compared to the S&P 500 index, which was up 8.5% in Singapore dollar terms. Since inception on 13 July 2020, the aforementioned series was up 17.2% compared to the S&P 500 index which was up by 113.1%.

Fundamentally, most of the stocks in Compounder Fund’s portfolio reported a strong set of results for 2025’s second-quarter.

One of the fund’s top performers year-to-date is Tencent, which is up 52% as of the time of writing. Tencent reported a strong set of results for the second quarter of 2025 with revenue up 15% and gross profits up 22%. The Chinese tech giant has continued to benefit from its focus toward higher margin products and is leaning in on AI to improve overall efficiency. With the Chinese government’s more positive stance toward business health in recent months, Tencent has also benefited from the broader optimism in Chinese stocks.

Overall, the results of Compounder Fund’s portfolio companies continue to be positive and we believe, barring unforeseen circumstances, our portfolio companies can continue to enjoy strong long-term growth in their businesses.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Vision Capital Fund

Fund Description: Vision Capital Fund is an open-ended fund that focuses on long-only global equities. This fund aims to deliver superior, sustainable, compelling long-term (over five years and more) returns for investors by investing in the stock market, specifically in quality, durable, and innovative compounders, riding secular tailwinds that can grow profitably and durably well for a long time at high rates of returns.

Fund Updates

As of Sep 30, 2025, Vision Capital Fund’s Class A shares are up +15.6% year-to-date compared to the S&P 500’s +14.8%.

Since its inception (Oct 1, 2024), we have continued our outperformance, up +27.8% compared to the S&P 500’s +17.6%.

Vision Capital Fund celebrated its first anniversary with the best possible start we could ask for. We nearly doubled our assets under management, with half from capital gains and half from new and existing investors joining us on this journey. We started with 25 investors and added nine new investors over the past year, with a quarter of existing investors having added follow-on capital.

During Q3, we maintained our discipline with zero portfolio turnover—we sold nothing. We added ten existing positions and welcomed one new holding: Cloudflare, bringing our total to 27 positions. Twenty percent of the internet flows through Cloudflare’s network. We remain primarily invested at 98.7%.

The quarter saw challenges in three holdings. Meituan faced intensified competition from JD.com’s aggressive entry into food delivery, temporarily compressing margins. The Trade Desk navigated softer ad spending and its Kokai platform transition. Lululemon faced ongoing US market headwinds and inventory challenges, necessitating higher markdowns. We view these as temporary setbacks in otherwise strong long-term franchises.

Our biggest winner remains Palantir, which reaccelerated revenue growth to 48% with improving profitability. When short-seller Citron attacked in August with an unfounded report, we seized the opportunity to add to our largest position at attractive prices.

Books reveal what you think. Stocks reveal what you believe. Holding periods reveal who you really are. We remain actively inactive, patient, and optimistic about the long-term prospects of the outstanding businesses we own alongside you.

If you wish to find out more about investing with Vision Capital Fund, don’t hesitate to get in touch with eugene.ng@visioncapitalfund.co.

Similarly, you can visit our website to find out more:

Contact us

Kindly email us at investor_relations@galileeinvestment.com or contact your usual Galilee contact if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.) Kindly also inform us if you cease to be an Accredited Investor under the SFA at any time.

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Galilee makes no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio given changing market conditions. Please consult a professional investment consultant prior to making any investment decision.