Q4 Investors' Newsletter

October 2024

Galilee Investment Management

Message from COO

Mr. Lawrence Lim,

COO

Dear Investors,

I am pleased to share several significant milestones and developments as we continue our journey at Galilee.

Firstly, we are delighted to announce that as of 1 August 2024, Galilee has been officially granted a Capital Markets Services (CMS) License by the Monetary Authority of Singapore (MAS). This license allows us to operate as a Licensed Fund Management Company (LFMC) for accredited and institutional investors. Transitioning from the RFMC regime to the LFMC framework marks a crucial step forward for Galilee, further solidifying our commitment to upholding the highest regulatory and compliance standards.

Over the past two months, we have fully embraced the LFMC reporting requirements, ensuring our operational framework is aligned with the rigorous standards set by MAS. We remain dedicated to maintaining transparency and compliance in all aspects of fund management, continually enhancing our processes to meet and exceed expectations.

Lastly, we are excited to welcome a new member to the Galilee team. Eugene Ng joined Galilee in August 2024 as a Portfolio Manager. He will be managing Vision Capital Fund, which has officially launched on 1 October 2024. We are confident that Eugene’s extensive experience and strategic vision will bring valuable insights to Galilee and his fund. More information about Eugene and the Vision Capital Fund will follow shortly.

Mr. Eugene Ng, Portfolio Manager

Eugene Ng is a seasoned finance professional and investor with a strong academic background and a diverse range of corporate experiences. He graduated summa cum laude from Singapore Management University with a Bachelor of Science in Economics and a second major in Finance. During his university years, Eugene consistently demonstrated academic excellence, earning a place on the Dean’s List for three consecutive years. His academic journey also included an overseas exchange at the prestigious Warsaw School of Economics, where he achieved top distinctions across multiple subjects.

Eugene’s professional career began at Citibank Singapore, where he held various roles in marketing, portfolio management, and treasury sales. He quickly distinguished himself as a high performer, launching successful products and driving significant revenue growth in bancassurance and FX products.

He further honed his expertise at J.P. Morgan as Vice-President of FX & Rates Derivatives, Corporate Sales. In this role, Eugene provided comprehensive treasury solutions to multinational corporations, managing FX and derivatives portfolios while delivering strong revenue growth year-on-year. His deep understanding of corporate finance, risk management, and financial products positioned him as a leading figure in the FX space.

Eugene’s corporate trajectory continued at Archer-Daniels-Midland (ADM), where he served as Senior Structured Trade Finance FX Originator. Here, he managed complex FX arbitrage strategies and executed cross-currency hedging activities for portfolios in excess of $10 billion. His work at ADM solidified his expertise in global financial markets and large-scale financial structuring.

Eugene is also the author of the Amazon best-selling book Vision Investing, where he shares his investment philosophy, empowering others to achieve long-term financial success. He actively gives back through philanthropic efforts, donating a portion of his investment proceeds to charitable causes.

That is all from me but do read on for fund specific updates. We would like to thank you for your patience and continued support. Please feel free to reach out to us if you have any feedback.

Regards,

Lawrence Lim

fund Specific updates

Galilee Investment Fund VCC - Sub-Fund 1

Galilee Fixed Income Fund

Fund Description: Galilee Fixed Income Fund is an open-ended fund that focuses on sourcing out good quality assets which require debt funding, giving investors the opportunity to participate in specific projects of their choice. The Sub-Fund will invest primarily in real estate backed private or public fixed income products or deals. The Sub-Fund aims to provide investors with a stable annual dividend income yield of between 6-10% net of fees, paid out quarterly, over the long term.

Fund Updates

Prime Land Bank for Potential Education Hub Transformation

In July 2024, we launched a new project to raise funds to purchase a piece of a prime land parcel located in the vibrant and expanding city of Phnom Penh, Cambodia. The land parcel is situated in a strategic area, offering excellent connectivity to key urban infrastructure and proximity to major roads, transportation links, and essential city amenities.

The initial investment raised has been successfully deployed to purchase a part of the land, with collateral secured on the loan. This initial funding forms the first phase of a multi-year project to potentially transform the piece of land into an educational hub.

The development team has commenced active marketing to attract potential investors and partners to achieve the vision for transforming the land parcel into an educational hub educating future generations of Cambodians towards fulfillment of becoming a middle-income country by 2050. Check out the promotional video below !

Click here or contact investor_relations@galileeinvestment.com if you wish to find out more!

Latest Economic Developments in Cambodia

Check out the latest articles featuring Cambodia’s development and growth to understand why investing in Cambodia will continue to have a place in your investment portfolio.

A rental tax grace period has now been granted to allow landlords’ tax exemptions during periods in which renovations to properties and other specified non-renting periods are granted to lessees within lease agreements, according to an official instruction released by the General Department of Taxation (GDT) this month. Full article here (Khmer Times).

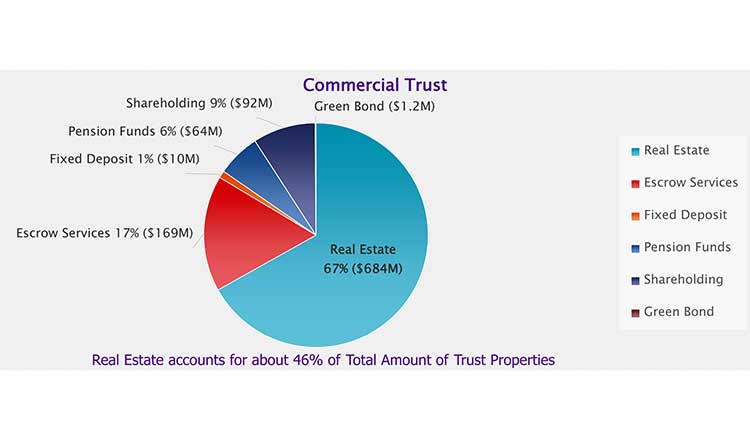

Foreigners are most keen on using the Cambodian government’s Trust framework for buying property in the country, rather than using it for pensions, fixed deposits, buying shares, green bonds or other purposes as per the latest data. Full article here (Khmer Times).

The Kingdom’s growing property market, which has already seen the approval of more than 1,300 construction projects to cover more than 4 million sqm in 2024, as well as the addition of an estimated 14,000 condo units expected by the end of the year. Full article here (Khmer Times).

The Phnom Penh’s office space sector’s overall occupancy rate has grown to 61.8 percent in the first half of the year and retail space to 58.7 percent, according to the latest market surveys of Phnom Penh-based agency and consultancy, CBRE Cambodia, as detailed in the firm’s mid-year 2024 report this month. Full article here (Khmer Times).

Fund Description: Compounder Fund is an open-ended fund that focuses on long-term investing in public equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Updates

As of 31 August 2024, the fund’s earliest series for its Class A shares is up 15.2% year-to-date compared to the S&P 500 index which is up 18.3%. Since inception on 13 July 2020, the aforementioned series is down 1.3% compared to the S&P 500 index which is up by 79.4%.

Stocks in general continued their upward trend in the third quarter of 2024 with the S&P 500 hitting fresh all time highs. US Markets look to have been buoyed by a 50 basis points cut in interest rates by the Federal Reserve and positive economic data. The quarter also ended strongly for Chinese stocks which were driven by stimulus from the Chinese government.

From a portfolio perspective, Compounder Fund initiated a new position in Cassava Sciences in August. Cassava Sciences is an early-stage biotechnology company that is currently researching a potentially groundbreaking drug for Alzheimer’s Disease. The drug showed excellent Phase 2 data and is now in Phase 3 trials. Should the Phase 3 trials show positive data and the drug receive FDA approval, the potential market for Cassava Sciences will be sizeable, which was believe makes this investment an asymmetric opportunity for the fund.

During the quarter, Compounder Fund also trimmed its stake in MongoDB while increasing its stake in Visa in the portfolio.

From a fundamental standpoint, the companies in Compounder Fund’s portfolio posted a positive set of results for 2024’s second-quarter. The portfolio companies had an average revenue growth of 13.5% and average free cash flow margins of 18%.

Overall, we continue to believe that stocks in the fund’s portfolio still look relatively reasonably priced and can continue to rise in the long term.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Fund Description: The Fund was created to achieve a target annual compounded return of 18% net of fees through investment in residential real estate development in Cambodia. This closed-ended fund started in January 2020 and is targeted to close no later than December 2024. The target fund size is US$37 Million.

Fund Updates

The fund redemption was successfully completed on 19 September 2024. We are now in the process of striking off the company, with a target completion by the end of this year.

VC VISION CAPITAL VCC - Sub-Fund 1

Vision Capital Fund

Fund Description: Vision Capital Fund is an open-ended fund that focuses on long-only global equities. This fund aims to deliver superior, sustainable, compelling long-term (over five years and more) returns for investors by investing in the stock market, specifically in quality, durable, and innovative compounders, riding secular tailwinds that can grow profitably and durably well for a long time at high rates of returns.

Fund Updates

On 1 October 2024, we successfully launched Vision Capital Fund. We managed to raise USD 6.46 million from our investors, with more expected to join in the coming months. We have identified a portfolio of 20-30+ companies that we will be looking to establish core long-term positions in. Exact holdings and detailed investment thesis for our positions will be published gradually in the restricted Partner’s Materials section of our website for our investors.

If you wish to find out more, please contact eugene.ng@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Contact us

Kindly email us at investor_relations@galileeinvestment.com or contact your usual Galilee contact if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.) Kindly also inform us if you cease to be an Accredited Investor under the SFA at any time.

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Galilee makes no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio given changing market conditions. Please consult a professional investment consultant prior to making any investment decision.