Q1 Investors' Newsletter

January 2026

Galilee Investment Management

Message from Chief Operating Officer

Mr. Franklin Chua,

COO

Dear Investors,

Warmest wishes for a Happy New Year. We sincerely hope that 2026 brings you continued success, good health, and meaningful new opportunities.

As we usher in the new year, I would like to express my heartfelt appreciation for the progress we have achieved together over the past few years. I am pleased to report that all our funds performed strongly throughout 2025. Detailed performance insights will be shared by each team in their respective fund updates.

On the philanthropic front, our sister organisation, Galilee Foundation, has been presented with a meaningful opportunity to explore the establishment of a school in Cambodia. Preparatory efforts are currently underway, encompassing planning and renovation works to ensure the facilities meet the required standards for a safe and conducive learning environment. In parallel, we have initiated the early stages of recruiting qualified teaching professionals, with a strong emphasis on building a committed and capable team to support the school’s educational mission and long-term sustainability.

Looking ahead, we remain optimistic about the year ahead, with potential new VCC partnerships and sub-fund launches currently in the pipeline.

Do explore the fund-specific updates by clicking on the button below!

Galilee Fixed Income Fund

Fund Description: The Fund adopts a diversified investment strategy focusing on sourcing and evaluating public and private fixed income products, specifically in areas of specialty financing, senior/subordinate real estate backed debt, factoring/trading financing, direct lending and corporate bonds, offered globally, to provide investors with a stable and consistent dividend yield through the market cycle.

Fund Updates

We are pleased to announce that since inception, the Galilee Fixed Income Fund has delivered a consistent annualized return of over 9%, with quarterly dividend payouts 和 no defaults across 14 consecutive quarters, highlighting our commitment to capital preservation and steady income generation.

Over the next 12 to 24 months, the Galilee Fixed Income Fund intends to selectively allocate capital to Cambodia-focused investment opportunities that demonstrate compelling growth prospects consistent with our return objectives. We will provide further updates as a number of potential projects progress through our evaluation pipeline.

Manhattan Special Economic Zone (MSEZ) – Affordable Housing Update

We are pleased to provide an update on our affordable housing initiative within the Manhattan Special Economic Zone (MSEZ) in Cambodia. We are currently engaging architectural services to develop the schematic design for the housing development. Each home is being carefully planned to strike a balance between cost efficiency and functional quality, ensuring the units remain affordable while meeting essential living standards.

The design process also incorporates broader planning considerations, including sustainable waste management solutions and thoughtfully designed green spaces. Our goal is to create a well-planned, environmentally responsible, and livable residential community that addresses the long-term needs of its residents.

Additionally we would also like to share insights from the article on the MSEZ, highlighting its role as a model for industrial and economic development in Cambodia. The article also notes that Galilee Foundation plans to establish a nursery in MSEZ, with a gradual expansion into a K–12 international school and Galilee Fund will develop 2,000–3,000 affordable housing units surrounding the park, providing fair and stable housing for workers and managers.

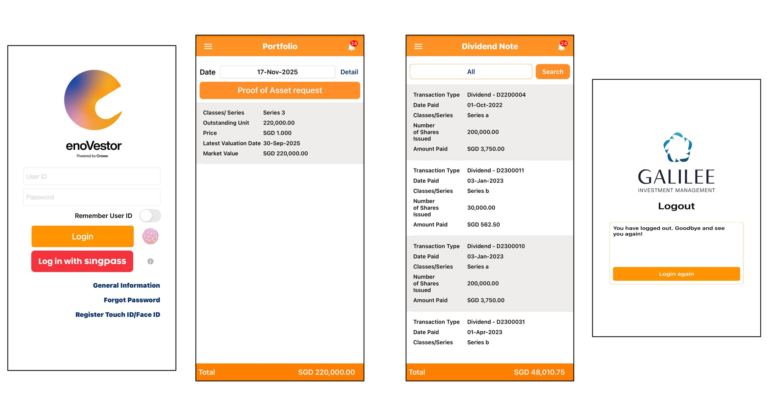

Launch of enoVestor App

We are excited to announce the official launch of the enoVestor App for the Galilee Fixed Income Fund in November 2025, developed in collaboration with our fund administrator. The app is designed to provide investors with a seamless and convenient way to access fund information and stay updated.

For investors who have already been onboarded, we welcome your thoughts and feedback to help us enhance your experience. For those who have not yet completed the onboarding process but are interested in accessing the app, please reach out to us to get started.

The enoVestor App marks another step in our commitment to providing transparent, accessible, and efficient fund management for all our investors.

点击此处 or contact investor_relations@galileeinvestment.com if you wish to find out more!

Latest Economic Developments in Cambodia

The Economic and Financial Policy Committee (EFPC) Monday held a review meeting on the draft policy of the development of social and affordable housing, a strategic initiative aimed at addressing the growing demand for affordable residential options among low- and medium-income families. Full article here (Khmer Times).

Cambodia approved 3,503 construction projects this year, representing a combined construction floor area of more than 18 million square metres and a total investment value of $7.32 billion — a significant 68.89 percent increase compared to 2024, according to the Ministry of Land Management, Urban Planning and Construction’s (MLMUPC) report yesterday. Full article here (Khmer Times)

Cambodia is making it easier for international buyers and investors to handle real estate transactions with two big updates in digital payments. Full article here (Khmer Times).

The future looks bright for Cambodia’s industrial real estate sector, which is rapidly emerging as a key pillar of national growth, experts said during a high-level discussion on foreign investment structures in the commercial and industrial property market, held yesterday by AmCham at Connect Centre by realestate.com.kh in Phnom Penh. Full article here (Khmer Times).

Fund Description: Compounder Fund is an open-ended fund that focuses on long-term investing in public equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Updates

Compounder Fund’s latest 2025 fourth-quarter letter was published on 13 January 2026 and you can find it here.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

Vision Capital Fund

Fund Description: Vision Capital Fund is an open-ended fund that focuses on long-only global equities. This fund aims to deliver superior, sustainable, compelling long-term (over five years and more) returns for investors by investing in the stock market, specifically in quality, durable, and innovative compounders, riding secular tailwinds that can grow profitably and durably well for a long time at high rates of returns.

Fund Updates

As of 31 Dec 2025, Vision Capital Fund’s Class A shares are up gross +12.7% and net +9.8%, versus the S&P 500’s +17.9%.

Since its inception (Oct 1, 2024), we have continued to outperform, up gross +27.0% and net +21.4%, versus the S&P 500’s +20.7%.

While we still outperformed from inception, the weaker Q4 2025 resulted in underperformance for 2025. While we strive to outperform over the long term, we are unlikely to consistently outperform every year.

We can’t control what the market does in any month, quarter, or year. Short-term returns come mostly from valuation swings, not business performance. But over time, business returns drive investment returns. That’s why we stay focused on owning companies that grow profitably, reinvest strongly, and compound durably.

Our top 5 largest detractors were Pro Medicus, Zscaler, Wise, Mercado Libre, and The Trade Desk, all of which saw significant price declines. During the quarter, we took advantage of more attractive price levels to add to 9 of our existing positions: Amazon, Meta, Mercado Libre, NVIDIA, Pro Medicus, ServiceNow, Spotify, TSMC, and Wise, several of which were among our largest decliners.

We initiated a 2% position in Sea Limited, Southeast Asia’s dominant e-commerce platform with 52% market share, in late December, bringing our total stock holdings to 28. We’ve long admired management’s disciplined turnaround since 2024. A 38% drawdown amid profit fears gave us an attractive entry.

Our portfolio turnover remains zero. We intend to own companies for as long as possible – until growth slows rapidly or our thesis breaks – so we expect turnover to stay low (<10%). This lets our winners run, rather than trimming our flowers to water our weeds.

Most of the money is made by buying, holding, and waiting, rather than by constantly rotating and trading, which most people do. In the former, we put a lot of effort into making our single buying decision well. Trading requires getting two decisions right — when to buy and when to sell — and repeating this indefinitely. Each trade multiplies your chance of error. Some do this well, but we simply don’t think we are any good at it.

We wrote three new investment memos on Spotify, Zscaler, and Sea Limited during the quarter. You may find all 22 of our memos in Partner Materials, accessible with your login credentials. You may access our latest 2025 annual letter here.

If you wish to find out more about investing with Vision Capital Fund, don’t hesitate to get in touch with eugene.ng@visioncapitalfund.co.

Similarly, you can visit our website to find out more:

Separately Managed Account (SMA)

Strategy Description: Frederick Tye is the Portfolio Manager for our Global SMA mandate, a concentrated, value-focused strategy. We employ a “barbell” approach, pairing high-quality franchises with opportunistic deep-value plays. We balance this with strategic exposure to short-term US Treasuries, preserving capital during expensive markets to deploy aggressively when attractive opportunities emerge.

Investment Updates

Composite SMA Performance Update (Since Inception): The mandate commenced operations on 1 August 2025. For the five-month period ending 31 December 2025, the SMA composite delivered a return of 1.41%, net of fees.

After a strong initial deployment in Q3 (reaching a cumulative high of 5.76% in September), the portfolio experienced a drawdown in Q4. We view this non-linear performance as inherent to a concentrated value strategy. We accept short-term volatility, particularly when the underlying businesses remain fundamentally sound.

Portfolio Commentary: Performance in the early months was driven by a robust recovery in our Chinese technology and US consumer growth holdings. We took advantage of the market dislocation in these sectors despite prevailing negative sentiment, as their strong cash flows and dominant market positions appeared disconnected from their depressed share prices.

The Q4 drawdown was driven by price declines in our niche legal finance and consumer staples holdings. We view these declines as temporary; the businesses themselves remain healthy.

A Realized Exit: During the period, we fully exited a position in a Malaysian automotive distributor. Upon re-evaluating the company’s distribution capabilities, we concluded the franchise was not as resilient as our initial analysis suggested. While we view the original analysis as a mistake, we were fortunate to exit with a realized gain, further bolstered by a strengthening Malaysian Ringgit. We accept the profit, but more importantly, we take the lesson.

Outlook: We enter 2026 with a cautious stance. We continue to hold a healthy cushion in short-duration US Treasuries, valuing the optionality that this liquidity provides. We seek both wonderful companies at fair prices and fair companies at wonderful prices. We remain patient, ready to deploy capital into either bucket when the odds are stacked in our favour.

If you wish to find out more, please contact fred@mscap.sg

Contact us

Kindly email us at investor_relations@galileeinvestment.com or contact your usual Galilee contact if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.) Kindly also inform us if you cease to be an Accredited Investor under the SFA at any time.

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Galilee makes no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio given changing market conditions. Please consult a professional investment consultant prior to making any investment decision.