Q3 Investors' Newsletter

July 2025

Galilee Investment Management

Message from Chief operating Officer

Mr. Franklin Chua, CFA

COO

Dear Investors,

It is my privilege to address you for the first time as Galilee’s Chief Operating Officer. I am deeply honoured to step into this role and build upon the strong foundation that has been established. As we look ahead to the second half of 2025, I am excited by the momentum we’ve gained and the opportunities that lie ahead.

This past quarter, Galilee marked several key milestones. We welcomed Mr. Frederick Tye, who will lead our Separately Managed Accounts with his strong investment expertise. Additionally, Mr. Edmund Koh joined as our Business Development Manager to drive strategic growth and strengthen investor relationships.

Our Investor Appreciation Party on 20 June 2025 was a meaningful celebration of our shared journey. We were glad to be able to allow a few of our Portfolio Managers to share their views about their fund! We also had lots of fun raising funds through a charity art auction for our main beneficiary, Cambodian Women’s Crisis Center. A big thank you to those who joined us and we hope to meet more of you at our future events. Your feedback is important to us so do reach out to us if you have any feedback on the event via this feedback form.

Once again, thank you for your continued trust and support with Galilee. I look forward to working with our dedicated team to deliver excellence and to achieve new milestones together.

Do check out the fund specific updates by clicking on the button below!

Introduction of Our New Portfolio Manager (Frederick Tye) And Business Development Manager (Edmund Koh)

We’re delighted to announce two new additions to the Galilee family:

Mr. Frederick Tye

Mr. Frederick Tye holds a Bachelor of Science in Business Administration from the University of Southern California. He began his career as an analyst at hedge fund Blue Edge Advisors before transitioning into the logistics industry. He is currently Director at Embassy Freight Services, a global logistics company operating in over 60 cities.

In addition, Mr. Tye serves as an Independent Non-Executive Director and audit committee member at Omnibridge Holdings Ltd, a public HR and recruitment firm listed on the Hong Kong Stock Exchange. He previously held an executive role at Mustard Seed Capital, an asset management company, and has independently managed his family investment portfolio over the last six years, achieving an average CAGR of about 20%.

Mr. Edmund Koh

Mr. Edmund Koh brings over 12 years of real estate experience across Asia, with strengths in sales, marketing, and project development. He has led high-performing teams, managed major portfolios, and driven cross-border initiatives. He is known for his strategic leadership and results-driven approach. We look forward to the fresh perspective he brings as we expand in the region.

Launch of New Separately Managed Accounts(SMAs) Services

We are proud to announce the official launch of our Separately Managed Account (SMA) offering, effective 1 August 2025, under the management of our new Portfolio Manager, Mr. Frederick Tye. This new service is designed to provide investors with greater flexibility, enhanced transparency, and personalised portfolio solutions that align more closely with each individual’s investment goals.

Celebrating 5 Years of Continuous Growth...

Galilee organized our Inaugural Investor Appreciation Party on 20 June 2025, held in conjunction with our 5 year anniversary, at the beautiful Seletar Country Club!

In partnership with Angkor Art Gallery, we also organised a charity art auction, where proceeds from the auction sales went to our beneficiaries, Galilee Foundation and Cambodian Women’s Crisis Center (CWCC), supporting underprivileged families and women who suffered from domestic violence, sexual abuse or human trafficking. Congratulations to all the winning bidders who walked home with a beautiful piece of art (and a Rolex watch), in support of a great cause!

A big shout out to our generous sponsors: Crowe Singapore, Nesuto Singapore, and the Mr Taitoon Lim from the Manhattan Life Foundation.

Last but not least, a BIG thank you to all our partners and investors who took the time to attend and celebrate this special day with us! Your presence and support made the occasion truly special.

Check out the posts and keep updated on Galilee’s LinkedIn 和 脸书 page.

#InvestingWithaHigherPurpose

Galilee Investment Fund VCC - Sub-Fund 1

Galilee Fixed Income Fund

Fund Description: The Fund adopts a diversified investment strategy focusing on sourcing and evaluating public and private fixed income products, specifically in areas of specialty financing, senior/subordinate real estate backed debt, factoring/trading financing, direct lending and corporate bonds, offered globally, to provide investors with a stable and consistent dividend yield through the market cycle.

Fund Updates

We are pleased to announce that Galilee Fixed Income Fund has successfully completed its largest redemption and reinvestment exercise since the Fund’s inception in July 2022. This milestone involved the full redemption of two short-term investment projects—GTECH Bridging Loan 和 26 HA Land Financing—each with maturities ranging from 12 to 24 months. Following their successful exit, investors were presented with a reinvestment opportunity, demonstrating continued confidence in the Fund’s strategy and management.

Since inception, the Fund has delivered a consistent annualized return of over 9%, with quarterly dividend payouts 和 no defaults across 12 consecutive quarters, highlighting our commitment to capital preservation and steady income generation.

Looking ahead, Galilee Fixed Income Fund will continue to deploy capital into Cambodia-centric investment opportunities over the next 12 to 24 months, where we continue to identify robust growth potential aligned with our target returns. We look forward to sharing details on several upcoming projects currently under evaluation.

Emerald Hotel Chain Expansion

Emerald Hotel Residence is a completed budget focused hotel located in the heart of Phnom Penh, known for its affordable and comfortable accommodations, high occupancy rates, and strong guest ratings. Building on its success, we are now raising funds to expand the hotel chain across Cambodia.

Data Center Expansion

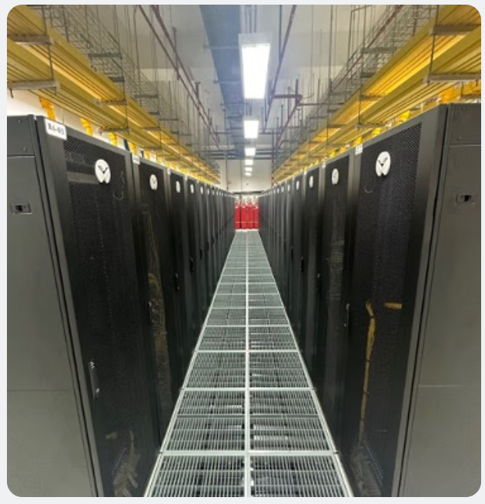

The Data Center, a fully constructed and operational asset located in Phnom Penh, Cambodia, forms a key component of the Global Tech Exchange Project and is operated by ByteDC Solutions.

We have identified compelling opportunities in Cambodia’s emerging data center leasing market, driven a Fit-Lease operational model. This model enables scalable deployment of infrastructure tailored to client requirements while optimizing operational efficiency.

A recent Memorandum of Understanding (MOU) signed with Huawei further affirms the strategic growth potential of the Cambodian digital infrastructure sector. ByteDC solutions had successfully raised $13M in funding to be allocated toward fitting out the existing facility with Huawei’s state-of-the-art equipment, enabling the provision of world-class cloud and data services to enterprises in Cambodia and the broader ASEAN region.

Urban City Campus Development – Phase 1 of the Global University Township

We have identified a strategically located parcel of land in Sen Sok, Phnom Penh, adjacent to AEON Mall 2 and the Australian International School, for the development of an Urban City Campus. This marks Phase 1 of the Global University Township, an ambitious initiative to transform an existing operational Cambodian university into a world-class University in Cambodia.

The Sen Sok district is rapidly transforming into an emerging educational hub, underpinned by significant investments in high-quality learning infrastructure. Notably, Shrewsbury International School, a prestigious UK-based institution, has announced the launch of its 7-hectare flagship campus in Sen Sok, with state-of-the-art facilities catering to early years, primary, and secondary students. This reinforces the area’s growing reputation as a magnet for international education.

点击此处 or contact investor_relations@galileeinvestment.com if you wish to find out more!

Latest Economic Developments in Cambodia

There are indications from the Cambodian real estate sector that the market is showing signs of recovery in 2025, supported by fresh supply and sustained investor interest, as highlighted by reports from the National Bank of Cambodia (NBC) and government officials. Full article here (Khmer Times).

Cambodia’s growing property market is supported by strong economic fundamentals, 6.1% GDP growth forecast, moderating inflation, and continued low benchmark interest rates. Developer financing and attractive mortgage schemes for foreigners are helping sustain buyer demand. With rental yields averaging 7.4% nationwide (6–10% in key locations), real estate remains a compelling hedge against inflation. Full article here (Bamboo Routes)

While international buyers still dominate real estate sales, local Cambodians now account for 18.2% of purchases, drawn by modern lifestyles and convenience. Developers are responding with enhanced quality, flexible payment plans (up to 50% due at completion), and a focus on livability. A “flight to quality” is underway, especially in centrally located and well-built projects. Full article here (Khmer Times).

Phnom Penh’s condominium market has cooled notably in 2025 after a boom from 2016 to 2021, with supply doubling to around 60,000 units and prices dropping 15–20% from their 2019 peak. Entry-level condos now range between US $1,500–2,200/m², rental vacancy has eased to ~15%, and net rental yields remain strong at 6.5–8%, particularly for larger units in central areas,indicating gradual market stabilisation and growth. Full article here (IPS Cambodia).

Fund Description: Compounder Fund is an open-ended fund that focuses on long-term investing in public equities around the world. The investment strategy is to find Compounders – public-listed companies that are able to grow their businesses at high-rates over the long run – through holistic fundamental analysis and holding onto their shares for years. The Fund aims to generate a 12% annualised return, net of all fees, over the long-term.

Fund Updates

As of 30th June 2025, the fund’s earliest series of its Class A shares was positive 0.9% year-to-date compared to the S&P 500 index, which was down 1.1% in Singapore dollar terms. Since inception on 13 July 2020, the aforementioned series was up 12.2% compared to the S&P 500 index which was up by 94.4%.

The second quarter of 2025 has been particularly volatile, with stocks in the USA dropping sharply in late-March and early-April following the Trump administration’s aggressive tariff plans. But just a few weeks later, the US government’s temporary softening of its stance on tariffs appeased the market, with stocks rebounding strongly. Since then, there have been other pressing news, such as the escalation of the conflict between Iran and Israel, with the USA potentially being dragged through the mud. Despite this, markets have held relatively steady.

From a portfolio perspective, Compounder Fund’s portfolio saw similar volatility in April but ultimately, the fund’s return for the earliest series of its Class A shares was mostly flat in April and up 7.7% and 2.9% in May and June respectively. The weakening of the US dollar against the Singapore dollar, however, has a negative effect on the portfolio’s performance. The US dollar fell from US$1-to-S$1.34 in March to around US$1-to-S$1.27, which has caused a drag of around 5% to the portfolio’s performance in Singapore-dollar terms during the quarter.

Fundamentally, most of the stocks in Compounder Fund’s portfolio reported a strong set of results for the past quarter.

In the last newsletter, we highlighted the strong performance of Meta, which is the largest position in the portfolio. Meta again performed admirably in the first quarter of 2025.

This quarter, we are highlighting Mercado Libre, the fund’s third-largest holding. In the first quarter of 2025, the Latin American e-commerce and digital payments giant reported a 17% increase in gross merchandise value and a 43% increase in transaction payment volume, two key metrics for the company. Consequently, revenue grew 37% and net profit soared 82% as the company continues to enjoy greater operating leverage. Although Mercado Libre’s stock price is up around 50% so far this year, we think there is room for considerably more growth given the strong fundamentals of the business and relatively reasonable valuation.

We also added one new position in the portfolio in the form of Shinhan Financial Group, which owns Shinhan Bank. Shinhan Bank is one of the largest banks in South Korea. When we first purchased its shares, its stock was trading at just 0.6x book value. South Korea’s government has pushed for companies in the country to improve their returns on equity and return more cash to shareholders. Shinhan Financial Group has duly obliged. Shinhan Financial Group is also making use of its low share price by buying back stock aggressively. We believe the combined effect of higher profitability and opportunistic buybacks will allow shareholders to reap good returns as the market rerates Shinhan Financial Group’s valuation.

Overall, the results of Compounder Fund’s portfolio companies continue to be positive and we believe, barring unforeseen circumstances, our portfolio companies can continue to enjoy strong long-term growth in their businesses.

If you wish to find out more, please contact jeremy.chia@galileeinvestment.com.

Visit our website to get the latest updates on the Fund’s Performance and Investment Theses:

VC VISION CAPITAL VCC - Sub-Fund 1

Vision Capital Fund

Fund Description: Vision Capital Fund is an open-ended fund that focuses on long-only global equities. This fund aims to deliver superior, sustainable, compelling long-term (over five years and more) returns for investors by investing in the stock market, specifically in quality, durable, and innovative compounders, riding secular tailwinds that can grow profitably and durably well for a long time at high rates of returns.

Fund Updates

As of Jun 30, 2025, Vision Capital Fund’s Class A shares are up +11.8% year-to-date compared to the S&P 500’s +6.2%.

Since its inception (Oct 1, 2024), we have continued our early outperformance, up +23.7% compared to the S&P 500’s +8.8%.

Vision Capital Fund experienced its most significant intra-period peak-to-trough drawdown of -23.6%, which was larger than the -16.8% for the S&P 500 (February 14 – April 4, 2025), as expected. This was driven by broad market concerns about escalating US trade policy (culminating in the April 2, 2025, Trump Liberation Day Tariffs), which would result in moderating earnings growth and increasing economic uncertainty. While that weighed heavily on short-term sentiment, the holdings of the Vision Capital Fund remain broadly intact, as most of the companies sell services rather than goods, and even companies that sold goods were not significantly impacted.

Thus, we saw that as an attractive buying opportunity. Our investors resonated with our calls in Mar-May 2025 to lean into the attractive broad market declines, resulting in a significant inflow of capital. That provided us with an advantage, allowing us to deploy some of that capital to add to several of our existing holdings at attractive prices. Just as quickly, the markets have recovered post-Trump’s policy reversal on April 9, 2025, with its 90-day tariff pause. Accordingly, Vision Capital Fund rebounded stronger and faster as sentiment rapidly reversed course, driven by strong company fundamentals, following the strong Q1 2025 earnings season reported in Q2.

Overall, most of the holdings in the Vision Capital Fund remain reasonably priced, and we remain optimistic about their strong long-term business prospects. However, at current prices, while we see some attractive long-term opportunities for us to add to, they are fewer than before. We continue to maintain high discipline in deploying any additional capital we have on hand to ensure attractive long-term returns.

If you wish to find out more about investing with Vision Capital Fund, don’t hesitate to get in touch with eugene.ng@visioncapitalfund.co.

Similarly, you can visit our website to find out more:

Contact us

Kindly email us at investor_relations@galileeinvestment.com or contact your usual Galilee contact if you have any questions, feedback or changes to your personal details. (Bank account, handphone, email address, residential address etc.) Kindly also inform us if you cease to be an Accredited Investor under the SFA at any time.

Disclaimer

This confidential Newsletter (“Newsletter”) has been prepared by Galilee Investment Management Pte Ltd (“Galilee”) for distribution to selected recipients only. This Newsletter is for information purposes and shall not be construed as investment advice or for marketing purposes. While reasonable care has been taken to prepare this document, the information contained herein may not be relied upon for accuracy or completeness; and any opinion or estimate contained in this document is subject to change without notice. This Newsletter must not be published, circulated, reproduced or distributed, in whole or part, to any other person without the prior consent from Galilee. Galilee makes no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio given changing market conditions. Please consult a professional investment consultant prior to making any investment decision.